Tempus AI (TEM): An emerging AI Giant

Tempus AI is becoming the AI backbone of the healthcare sector, which presents a multi-trillion dollar opportunity

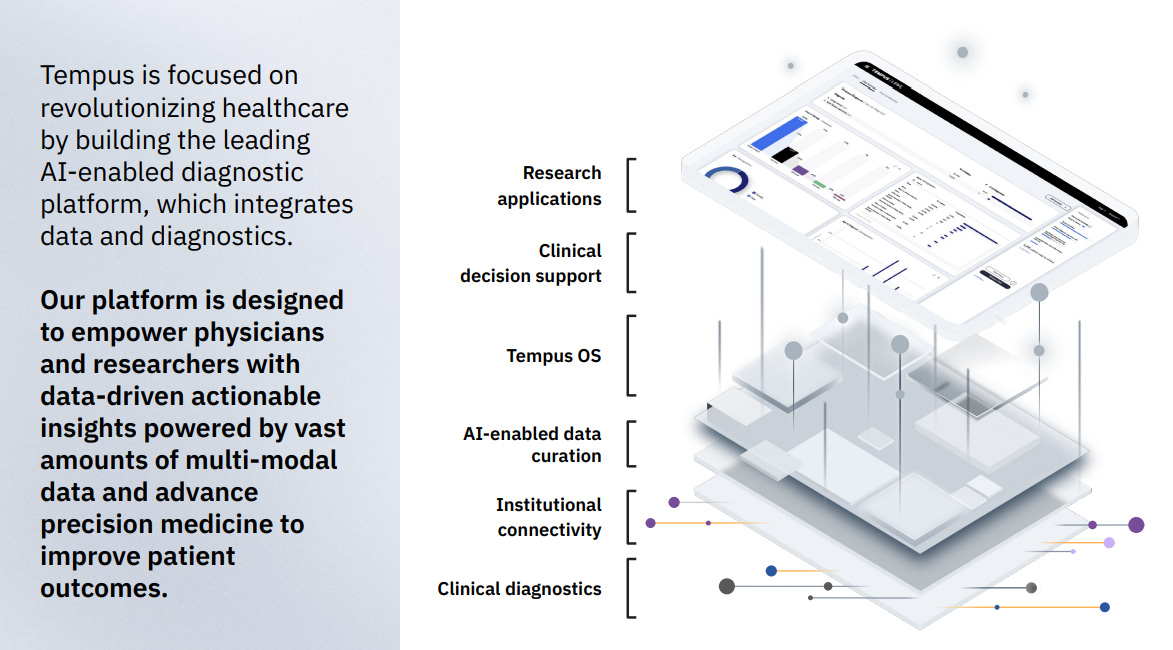

Tempus is an AI-driven precision medicine platform that’s quickly becoming the underlying infrastructure of modern US healthcare. It’s already deeply integrated into clinical workflows, widely used by top pharmaceutical firms, and holds a growing data advantage that few, if any, can replicate.

And yet, it’s still flying under the radar.

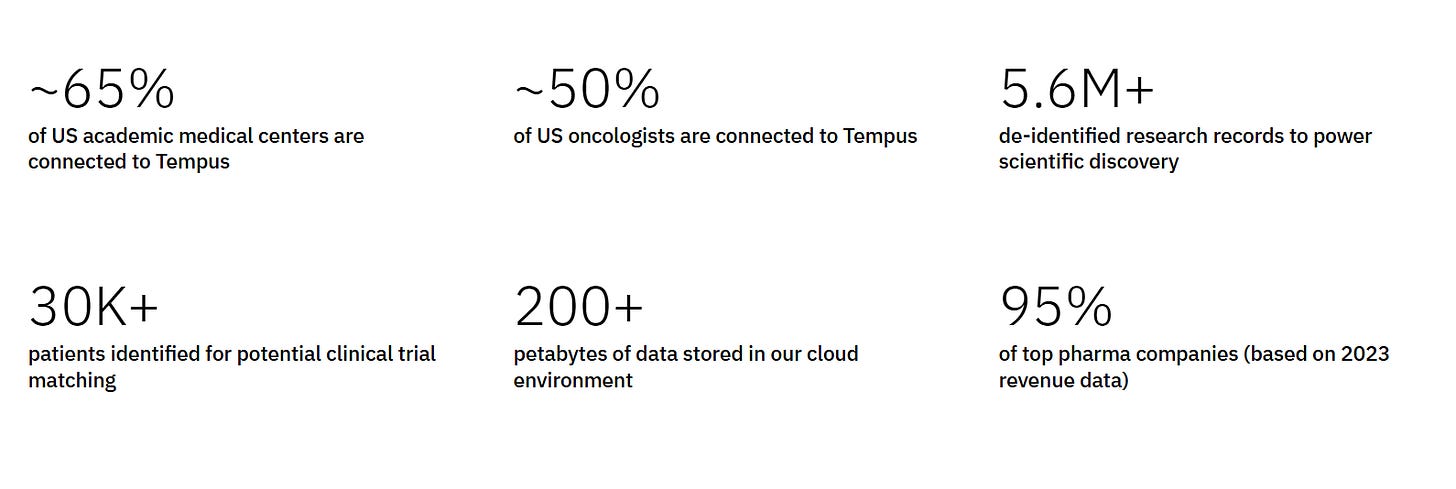

It trades at just ~6x NTM sales, has FDA-approved AI diagnostics, is used by 95% of the top pharma companies, and owns the kind of data moat that becomes more valuable with each passing day. There’s a strong case to be made that Tempus is quietly becoming the AI backbone of American healthcare.

Let’s dig in.

Disrupting healthcare from within

Tempus isn’t just a software company with a large data repository. It goes well beyond that. They’re already embedded within the healthcare system, giving them access to real-time data that continuously improves their AI models.

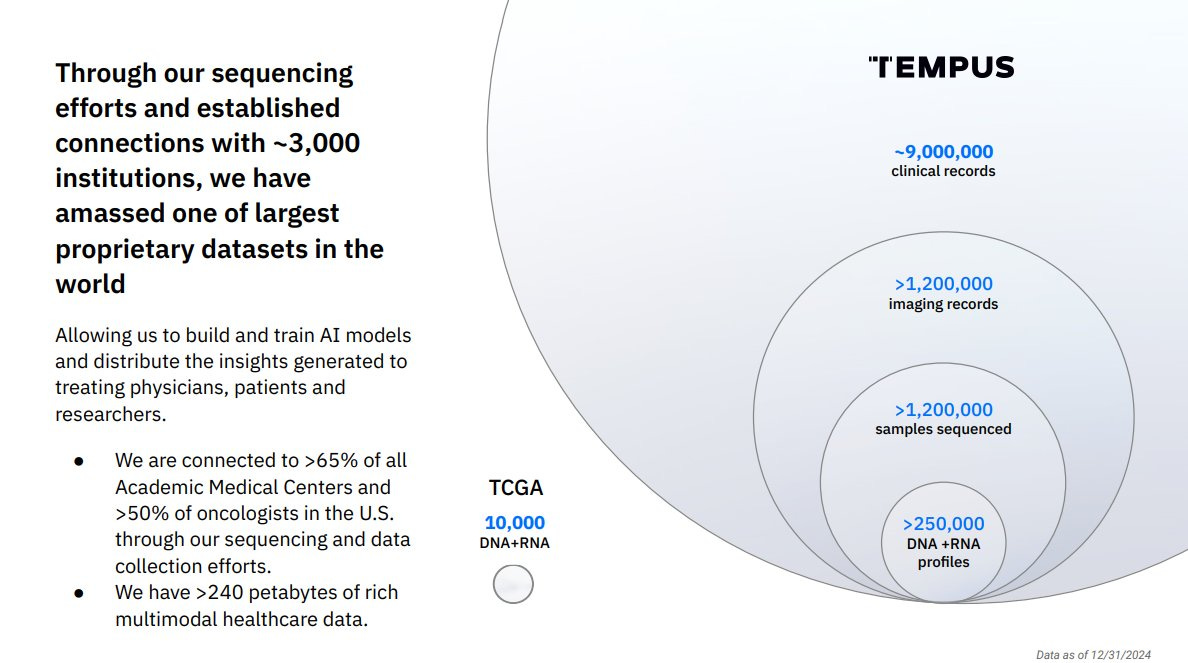

Their tools are used by 95% of top pharmaceutical companies, including AstraZeneca, Recursion, and Pfizer. With a strong focus on oncology, Tempus is connected to over 65% of all Academic Medical Centers and more than 50% of US oncologists through its sequencing and data collection efforts.

This creates a defensible moat that other companies simply can’t replicate.

You can’t just fund a startup and expect to compete with Tempus. Unlike other industries, healthcare data is highly private and difficult to obtain, and Tempus has already secured a position within a massive, uniquely valuable data pool.

Their access includes not only real-time patient data, but also comprehensive clinical and imaging records, along with the biological data collected from every patient they treat. This gives them a significant and growing advantage in the race to build the most capable healthcare AI.

All this data is then interconnected through Tempus software, which leverages AI to spot patterns across millions of patients. The power of combining massive datasets with advanced AI is immense.

Top AI experts consistently point out that the real bottleneck in AI isn’t the algorithms, it’s the quality of the data. And in healthcare, that kind of data is rare, private, and incredibly difficult to access.

Tempus not only has access to some of the highest-quality data in the industry, but they’re also using it in real time to continuously improve their models. This positions them to become a major AI force in healthcare, with a deep, defensible moat built around their unique data advantage.

Tempus is backed by important investors, which greatly boosts the credibility and the safety of the stock.

Google (approximately 1 percent ownership)

Novo Nordisk (2.5 percent ownership)

A diversified business model

The business is built around three primary revenue streams:

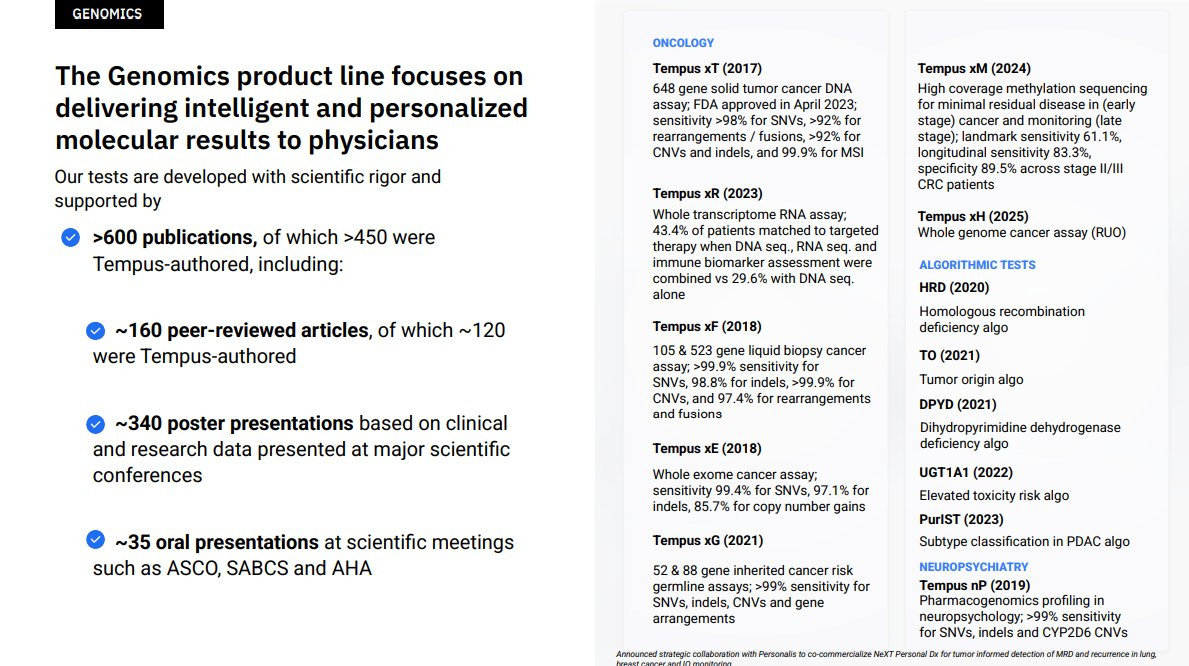

1. Genomics (Diagnostic Testing)

This is the foundation. Tempus provides DNA and RNA sequencing, molecular profiling, and germline testing across a wide range of conditions, with a strong focus on cancer.

They run high-quality tests that combine tumor data with clinical context, offering physicians rich, actionable insights, not just a list of genetic mutations in isolation. These tests are typically paid for through insurance reimbursement or direct payment by providers and research partners.

Volume: Millions of tests run to date

Use case: Personalized treatment decisions, clinical trial matching, disease monitoring

Differentiator: Combines structured clinical history, genomics, and imaging into a single, integrated diagnostic report

In a regular diagnostic, the test ends with a result. In a Tempus diagnostic, the result is just the starting point. The real value comes from context.

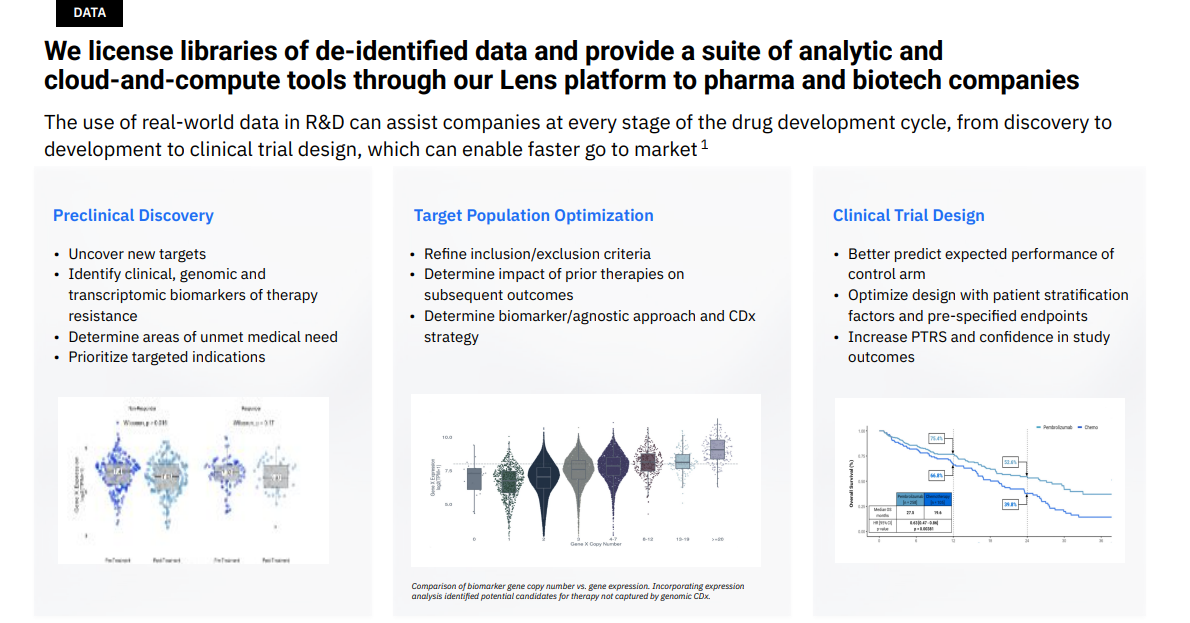

2. Data Licensing and Services

All of the sequencing and clinical tests generate structured, de-identified data, which is exactly what pharma companies need for drug development, clinical trial design, and AI model training.

Tempus licenses this data to 19 of the top 20 pharmaceutical companies, who use it to identify patient populations, optimize molecule selection, and simulate clinical pathways.

Dataset: Over 8.5 million fully structured cancer patient records, and more than 11 million additional partially structured records

Scope: Includes genomics, clinical data, imaging, digital pathology, and patient outcomes

Platform tools: Lens, Hub, Pixel, and Link, used to query, analyze, and visualize the data

This is one of the highest-margin segments of the business, with gross margins between 75 and 80 percent. Tempus currently has more than $900 million in signed contracts, most of which will be recognized as revenue over the coming years.

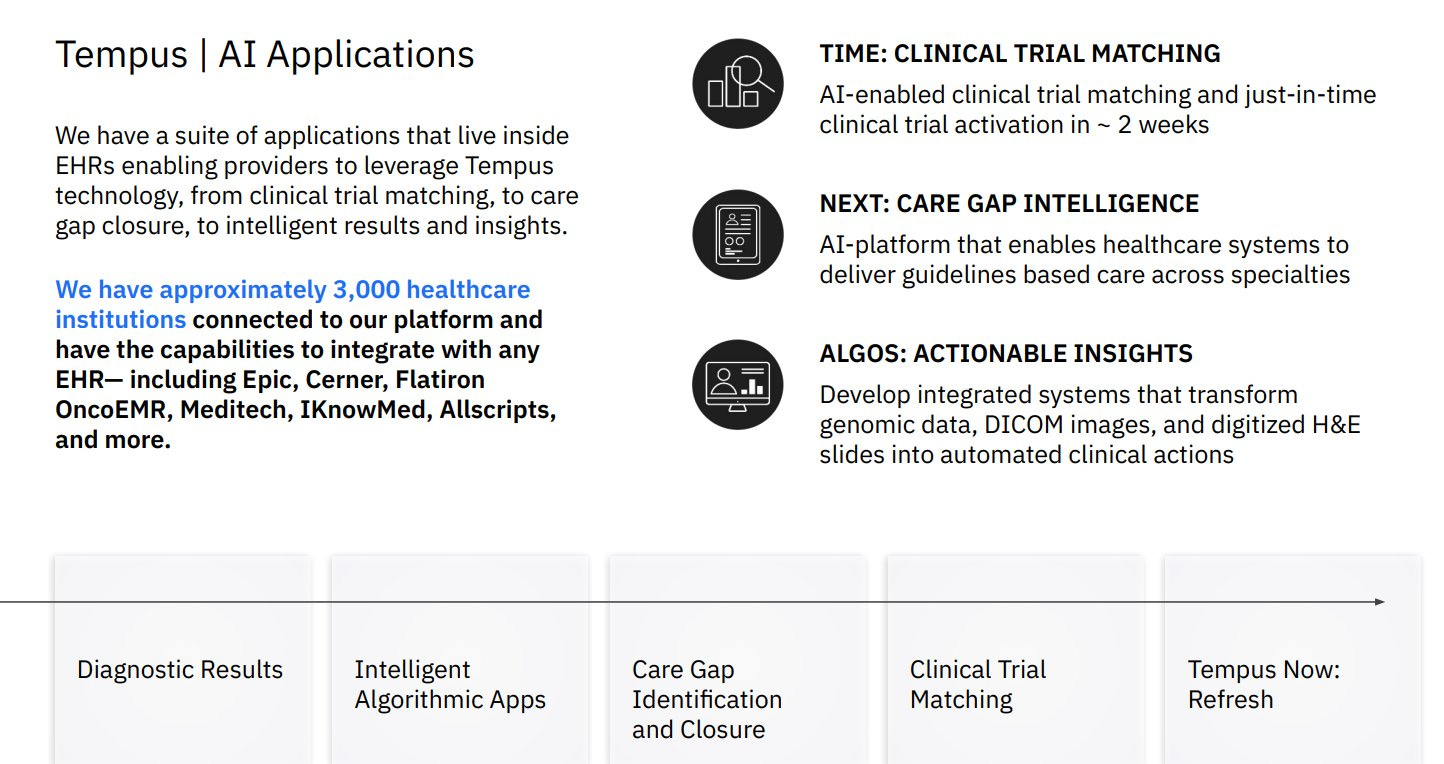

3. AI Applications

This is still a small slice of revenue, but potentially the most transformative in the long run. It includes AI diagnostics, clinical decision support tools, and trial matching algorithms, many of which are already FDA-approved and in active clinical use.

In 2024, this segment generated around $7.5 million, accounting for just 1.5 percent of revenue, but that could change significantly if AI-based tools gain reimbursement approval and adoption begins to scale.

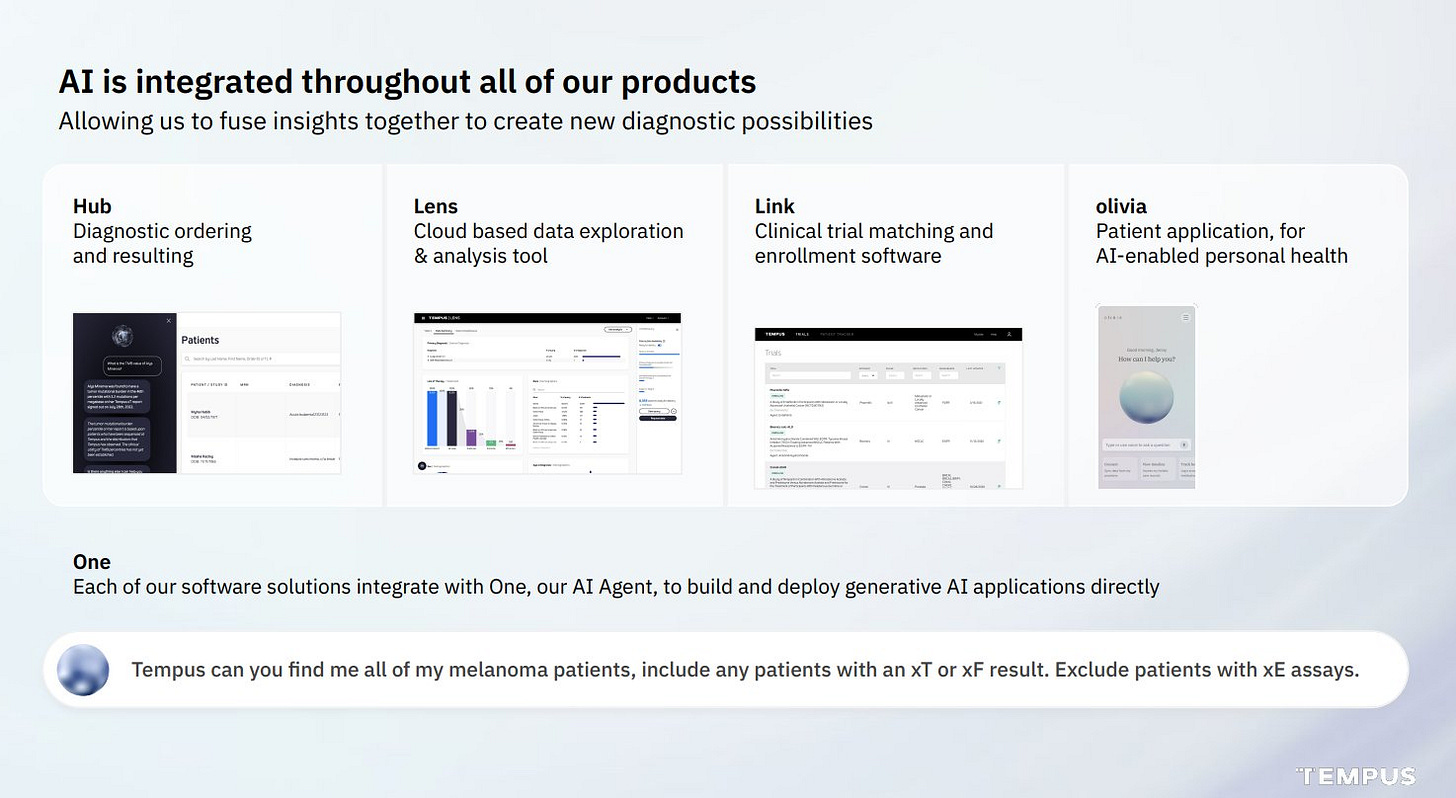

Tempus has already built an integrated AI platform that includes:

ONE: Patient data navigation for clinicians

Next: AI-assisted clinical trial matching

Lens: Analytics and cohort selection

Pixel: Imaging and radiomics interpretation

Link: Provider coordination platform

Hub: Central data and algorithmic dashboard

Each product is designed to plug directly into real-world hospital workflows. The goal is simple: healthcare professionals should be able to access up-to-date data on each patient instantly, while also leveraging the power of AI to support decision-making.

With Tempus, clinicians can receive real-time analysis, summaries of a patient’s medical history, draft letters, breakdowns of lab and scan results, and even suggested treatment plans based on patient-specific data. The platform helps doctors make the best possible decisions in the least amount of time.

Think about it. Every day, new research is published, new treatments are discovered, new diagnostics become available, new diseases emerge, and new drugs are developed, tested, and approved. It’s an enormous volume of information, and Tempus helps professionals in the most critical industry manage it effectively.

By providing the most comprehensive access to medical information and a platform that is intuitive, efficient, and AI-powered, Tempus allows clinicians to work smarter and save more lives.

There’s nothing more powerful than hearing a real physician explain how Tempus has made him more productive and better at his job:

Strategic Acquisitions That Strengthen the Moat

Tempus is expanding its ecosystem through high-value, strategic acquisitions.

Ambry Genetics

Acquired for $600 million ($375 million in cash and $225 million in stock), Ambry is one of the oldest and most trusted genetic testing companies in the US, processing over 400,000 patients per year.

This deal brings several strategic advantages:

Immediate scale in hereditary and germline testing

Expanded footprint into cardiology, rare diseases, pediatrics, immunology, and reproductive health

West Coast lab infrastructure

Access to more partnerships, clients, and datasets

Ambry is highly complementary to Tempus’ strong oncology foundation and positions the company to offer full-stack, population-scale genomic screening.

Deep 6 AI

Another major move. Deep 6 specializes in AI-powered clinical trial matching, using natural language processing to parse both structured and unstructured electronic health records. The platform is already connected to over 750 provider sites, with access to data from more than 30 million patients.

This acquisition brings several key benefits:

Faster trial recruitment

Better patient stratification

Expanded clinical trial revenue

Improved data sourcing across diverse populations

Both acquisitions, Ambry and Deep 6, compound Tempus’ data flywheel and help accelerate the company’s path to profitability.

Collaborations and Strategic Stakes

Tempus also holds a 19.3 percent stake in Personalis ($PSNL), a leader in tumor-informed MRD (minimal residual disease) testing. This partnership focuses on tracking patient response to immunotherapy in lung and breast cancer using the NeXT Personal Dx test.

They expect to test tens of thousands of patients over the next three years, pushing Tempus further into the growing MRD and longitudinal monitoring segments of oncology.

Financials

Keep reading with a 7-day free trial

Subscribe to Daniel Romero to keep reading this post and get 7 days of free access to the full post archives.