As one of the main positions in the portfolio, I’ll do a post to cover the earnings so all subs can stay updated.

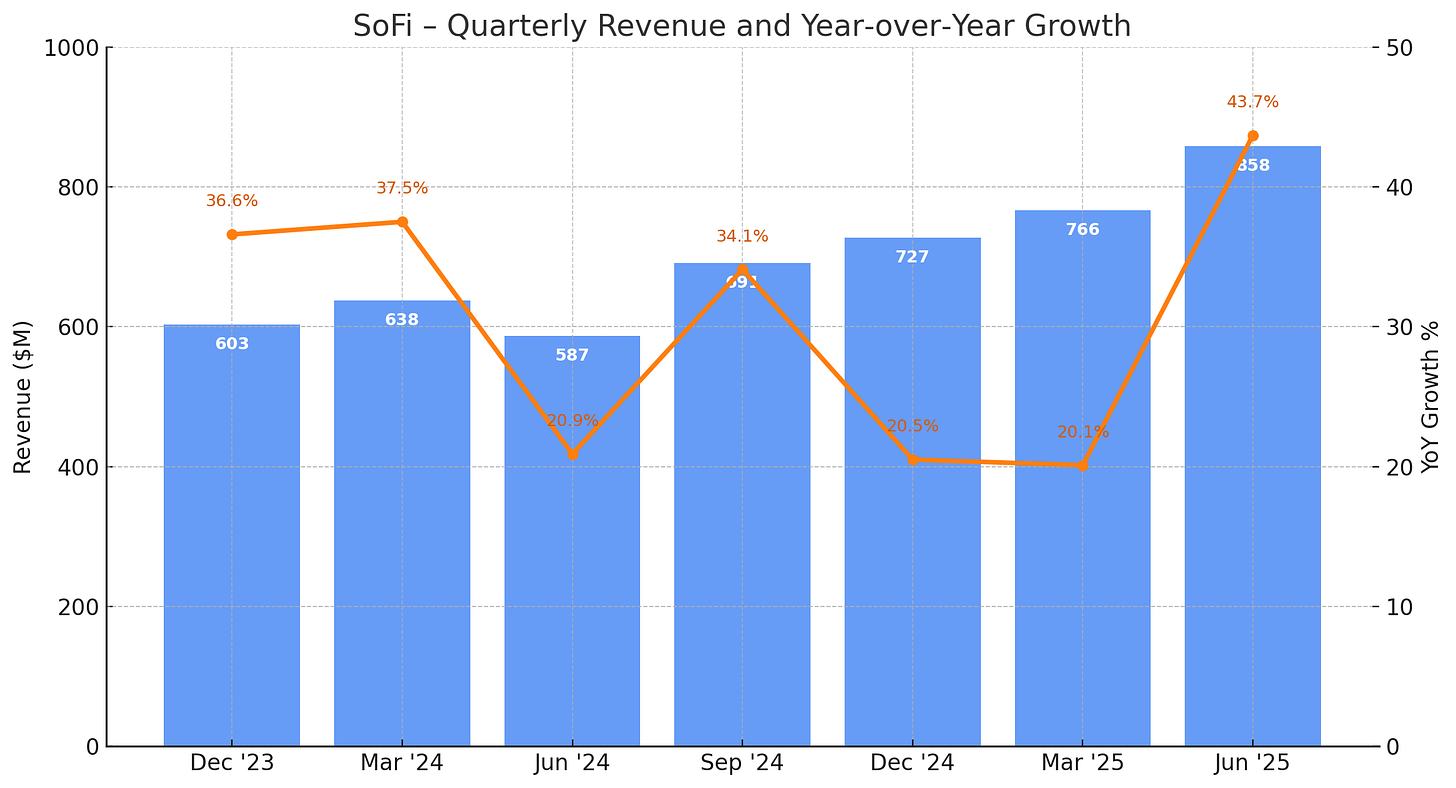

SoFi beat across the board, and as I outlined in my SoFi analysis in the portfolio update, we’re seeing revenue acceleration, which is very impressive for a company already generating over $800 M per quarter.

First, here’s a snapshot of the quarter:

Beat

• Revenue $858.2 M (+6.6 % vs est., +7 % vs guide)

• Members 11.75 M (+1.1 % vs est.)

• Tech-platform revenue (+4.5 % vs est.)

• Adj. EBITDA $249.1 M (+19.7 % vs est., +21 % vs guide)

• GAAP EPS $0.08 (+$0.02 vs est., +$0.025 vs guide)

• FY‑25 guidance raised: Revenue +3.1 %, EBITDA +8.5 %, GAAP EPS +0.035 (+0.03 vs prior)

KPIs & Growth

• Revenue $858.2 M (+11.4 % Q/Q, +43.7 % Y/Y, 2‑yr CAGR 32.5 %)

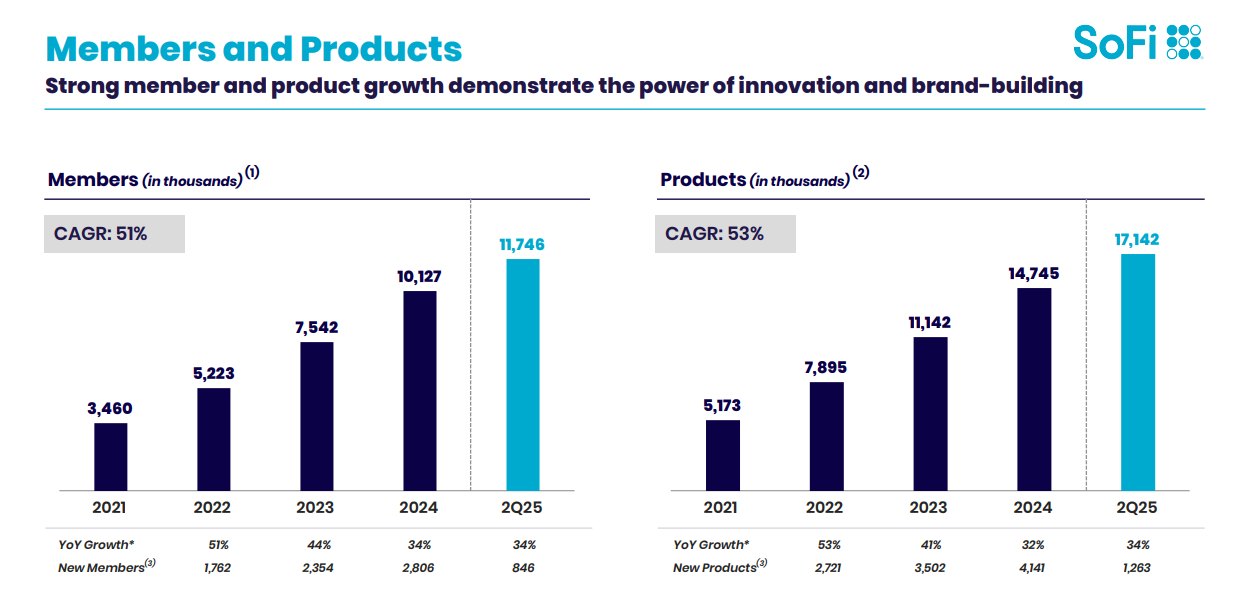

• Members 11.75 M (+7.6 % Q/Q, +34.0 % Y/Y, 2‑yr CAGR 37.2 %)

• Tech accounts 160.0 M (+1 % Q/Q, +0.9 % Y/Y, 2‑yr CAGR 11.2 %)

• EBITDA margin 29.0 % (+1.8 % Q/Q, +5.9 % Y/Y)

• Contribution margin 54.3 % (+0.1 % Q/Q, +6.7 % Y/Y)

• Net income margin 11.4 % (+2.1 % Q/Q, +10.1 % Y/Y)

• Common Equity Tier 1 (More is better) 14.3 % (+1.5 % Q/Q, +1.6 % Y/Y)

• Personal-loan lifetime default 4.28 % (vs 4.37 % Q/Q, 4.55 % two quarters ago)

Tremendous revenue acceleration:

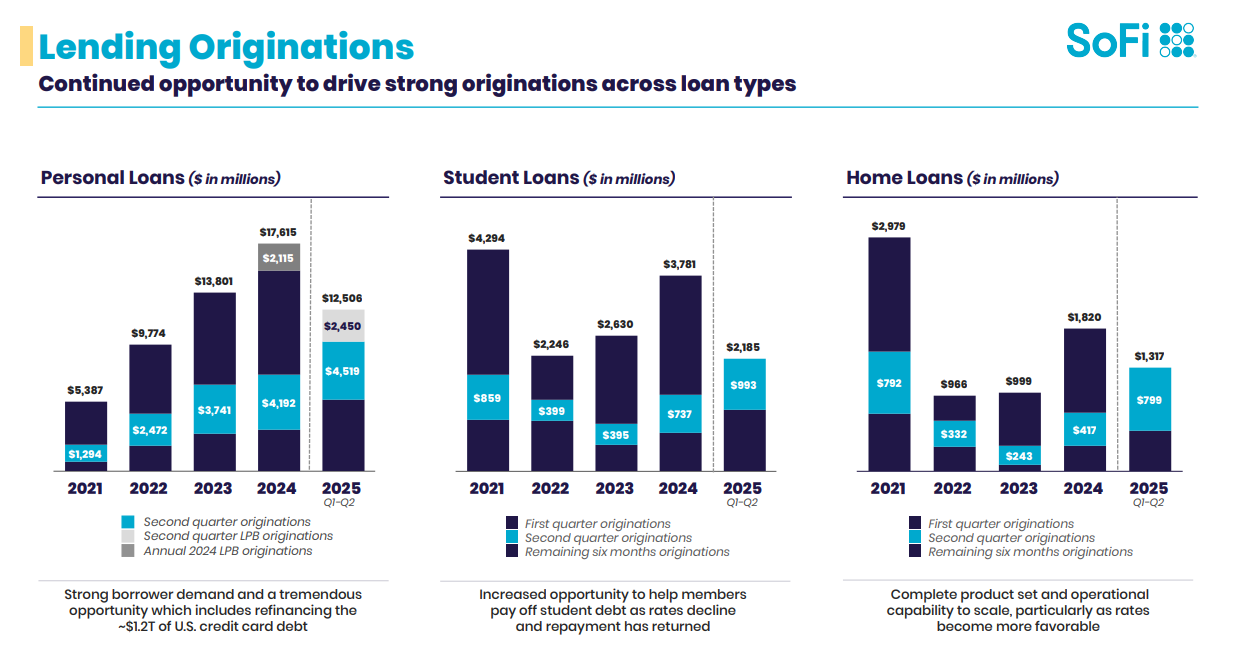

Loan portfolio growth is impressive, and that’s without the upcoming catalysts.

Once interest rate cuts arrive and the housing market reignites, SoFi will be able to leverage its greatly expanded member base to surpass 2021 origination levels.

The company was able to originate a massive volume of loans when it was much smaller and far less recognized. Now, as a fully established bank with stronger brand awareness and a complete product set, the growth potential is much higher.

In fact, CEO Anthony Noto said this about this segment:

We have nearly 3,000,000 members with a home loan at another institution, and we believe we’re well positioned to capture a significant share of the refinance volume as the rate environment improves.

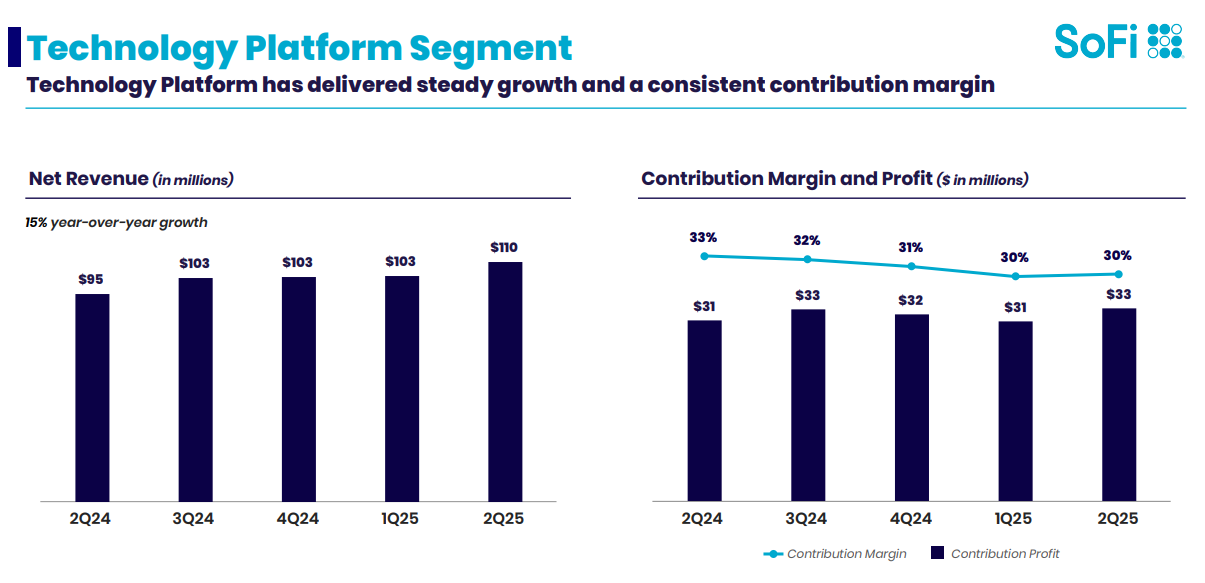

Technology Platform

Although there were some doubts about Galileo’s growth, this quarter cleared those concerns with a new wave of expansion.

This growth is supported, in part, by the launch of a rewards debit program with Wyndham Hotels & Resorts.

On top of that, they have signed two additional travel and hospitality companies, expected to launch before year-end.

Blockchain

SoFi aims to fully leverage blockchain technology as soon as possible. That’s one of their key advantages, while giant banks move slowly, SoFi is a fast, smaller disruptor that can move quicker.

The first innovation is self-serve international money transfers, allowing SoFi Money members to seamlessly and securely send money to dozens of countries, whether to support family abroad, make purchases outside the U.S., or manage money across borders.

These transfers will be fully automated in the SoFi app, at significantly faster speeds and lower costs compared to traditional services, putting more money in people’s pockets faster. Businesses will also be able to use this service.

How it works:

Members can initiate a transfer in the SoFi app by entering the recipient’s contact details and the amount to send in USD. Funds are transmitted on secure blockchain networks, converted into local currency, and deposited into the recipient’s account, all with full transparency on exchange rates and fees, 24/7 in the app.

The second crypto innovation is the return of crypto investing. A recent survey showed that 60% of SoFi members who invest in crypto would prefer working with a nationally licensed bank like SoFi over their current primary exchange.

Stablecoins

The Genius Act will take 12–18 months for full regulatory rulemaking. Competitors in the space won’t be able to obtain licenses until that period ends. SoFi has an advantage; as a licensed bank with special permissions, they can launch sooner than competitors.

SoFi won’t rush the offering, but they also won’t sit out the opportunity, given their head start.

Tokens

SoFi is exploring the tokenization of SoFi loans, making them available in liquid markets in small increments instead of tens of thousands of dollars, allowing anyone to invest in loans like equities.

Over time, SoFi sees opportunities across the entire platform, including:

Offering stablecoins

Allowing members to borrow against crypto assets

Expanding payment options

Introducing staking features

Providing blockchain and digital asset infrastructure through Galileo for other companies

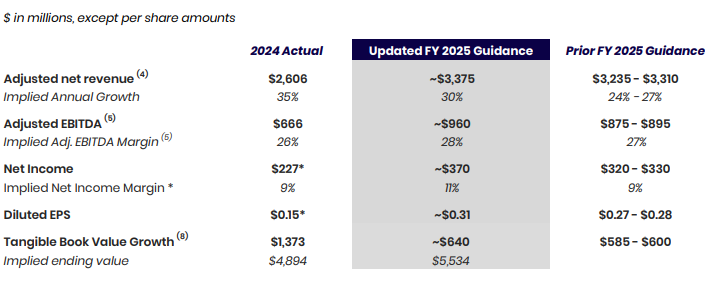

Full-Year Guidance

SoFi has raised its full-year guidance.

They’re now trading at 74x 2025 EPS.

This figure might seem high, but the company is guiding for 100% net income growth, and there are strong short- and mid-term catalysts supporting that valuation.

2027 P/E is expected in the ~30 range with 40%+ growth.

Not expensive considering they can compound at a 20%+ ROI for many years.

Looking Forward

Keep reading with a 7-day free trial

Subscribe to Daniel Romero to keep reading this post and get 7 days of free access to the full post archives.