Disclaimer: Fiscal Q3 corresponds to calendar Q2

Quantitative Highlights

Q3 Results

Micron’s Q3 earnings show what this company is: a high-growth AI play with a massive physical moat.

Year over year

Revenue: +36%

Gross profit: +89%

Operating income: +165%

Net income: +211%

Quarter over quarter

Revenue: +16%

Gross profit: +19%

Operating income: +24%

Net income: +22%

Q4 Guidance shows a very optimistic outlook

Year over year

Revenue: +38%

Gross profit: +48%

Net income: +86%

Quarter over quarter

Revenue: +15%

Gross profit: +16%

Net income: +15%

Results beat all analyst estimates

Sales: $9.3B vs Est. $8.9B

EPS: $1.91 vs Est. $1.61

Gross Margin: 39% vs Est. 37%

Q4 guidance also ahead of estimates

Sales: $10.7B vs Est. $9.9B

EPS: $2.50 vs Est. $2.03

Gross Margin: 42% vs Est. 39%

Performance was strong across all segments:

Data center revenue more than doubled year over year

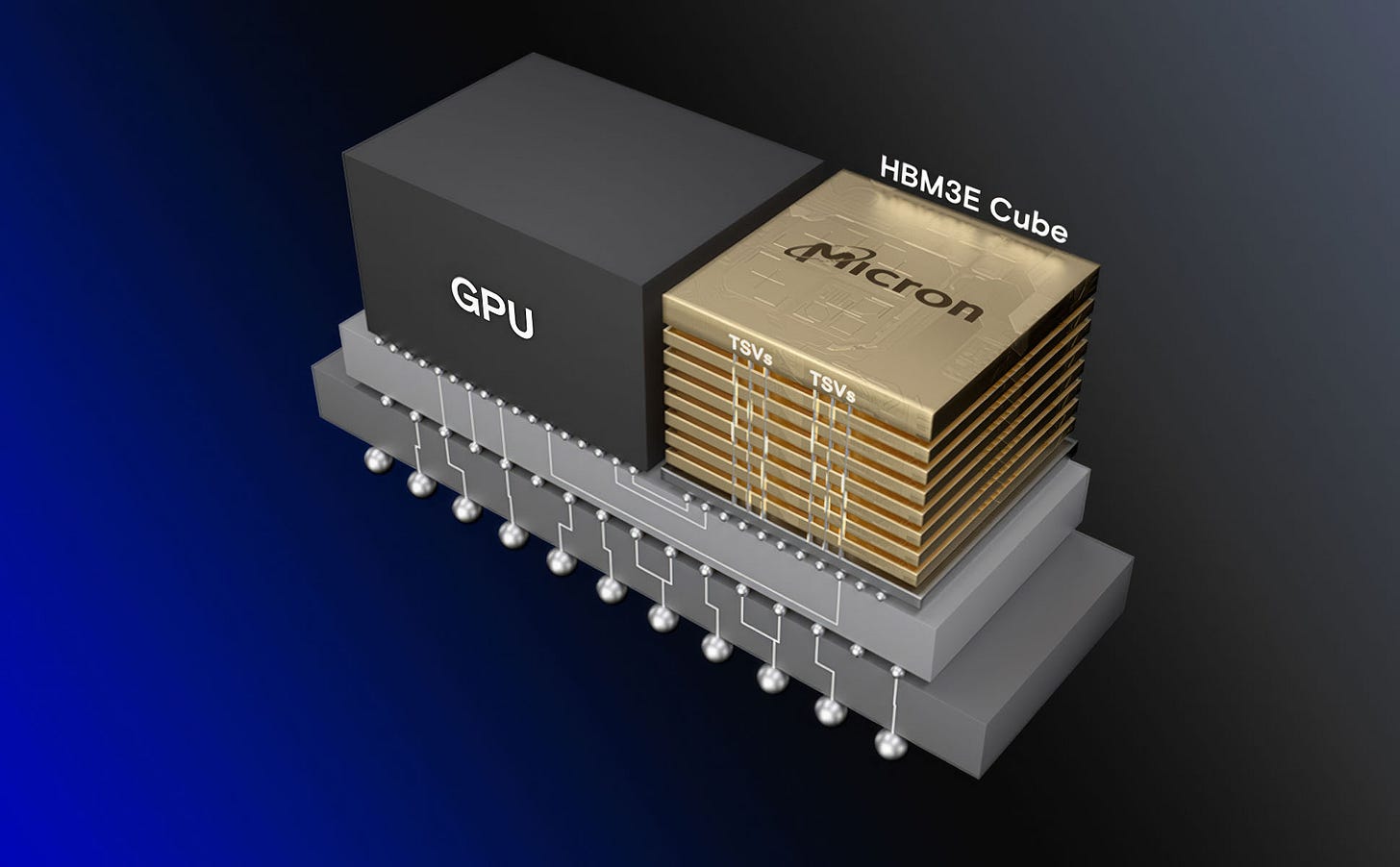

HBM revenue grew nearly 50% quarter over quarter

Client SSD and data center SSD market share reached record highs

Qualitative Highlights

The earnings were driven by strong performance across all segments:

HBM led the way, with 50% quarter-over-quarter growth

Micron remains the sole supplier of Low Power DRAM for data centers

Achieved an all-time high market share in both client and data center SSDs

For the first time ever, Micron ranked as the #2 brand by market share in data center SSDs during calendar Q1

HBM4 volume ramp is planned for 2026, targeting LLM workloads and inference applications

Micron is now shipping HBM to four customers across GPU and ASIC platforms

Two of these four customers are confirmed

AMD

At AMD’s Advancing AI event earlier this month, Micron’s 36GB 12-High HBM3E was announced as a key component in AMD’s Instinct MI355X GPU platform.

NVIDIA

Micron’s integration into NVIDIA’s AI platforms:

HBM3E 12-High (36GB) is designed into:

NVIDIA HGX B300 NVL16

NVIDIA GB300 NVL72

HBM3E 8-High (24GB) is used in:

NVIDIA HGX B200

NVIDIA GB200 NVL72

LPDDR5X-based SOCAMM, co-developed with NVIDIA, is integrated into the:

GB300 Grace Blackwell Ultra Superchip

The Micron 9550 SSD is qualified for:

NVIDIA GB200 NVL72

The shift towards DRAM

DRAM, especially data center DRAM (which includes HBM), is becoming a more significant part of the revenue mix, helping drive gross margin expansion.

Meanwhile, low-margin NAND and consumer DRAM are fading in relevance. With the ramp of 12-High HBM3E, this shift will accelerate starting in fiscal Q1, serving as a tailwind for both revenue and margins.

US Fab Expansion

This quarter, Micron also announced broad support from the U.S. administration for its domestic manufacturing expansion.

The company expects all of its U.S. investments to qualify for the Advanced Manufacturing Investment Credit (AMIC) and has already secured support at the local, state, and federal levels.

This includes up to $6.4 billion in CHIPS Act direct funding to help construct two Idaho fabs, two New York fabs, and expand and modernize its Virginia facility.

Micron could also benefit from the fact that Rep. Tenney (R-NY) introduced the Building Advanced Semiconductors Investment Credit Act, which proposes increasing the AMIC(Advanced Manufacturing Invetsment Credit) from 25% to 35% and extending it by four years.

The fab expansion will take place between 2025 and beyond 2045, as the New York megafab Micron’s largest planned facility is expected to consist of multiple fabs built in phases. The entire project is scheduled to span approximately 20 years.

Here’s what Micron’s U.S. expansion roadmap currently looks like:

The clear focus on DRAM and HBM will improve margins over the long term. HBM supply is expected to remain well below demand for at least the next 10 years, and depending on how AI progresses, we may see even stronger margins driven by ongoing demand for AI infrastructure beyond that.

The massive investment in U.S.-based manufacturing signals one thing: Micron doesn’t want to be a victim of geopolitical uncertainty. They understand the strategic advantage of being the only U.S.-based memory producer. Most demand comes from the U.S., they’ll receive generous subsidies, and they’re protected from direct impacts of tariffs or a potential conflict.

In my opinion, this is a core reason to invest in Micron. It’s an unmatched advantage. And if history is any guide, the U.S. remains the primary engine of technological progress. Not across every frontier, but over the long term, proximity to U.S. talent and the ability to operate primarily in the world’s most powerful economy will offer clear benefits.

Micron will also be eligible for contracts with the DoD, NASA, and federal AI compute initiatives, and benefit from the Buy American Act, giving them access to federal procurement deals.

On top of that, Micron is improving rapidly in its ability to develop cutting-edge memory technologies. This used to be a company that simply supplied commoditized memory. But today, R&D spending has tripled over the past nine years, and Micron has proven it can compete directly with the current memory leader, SK Hynix. The gap between them is narrowing.

It’s not that Micron’s technology is inferior; they’ve just been slightly behind on the development curve. But there’s a comment from the earnings call that suggests that’s changing. Manish Bhatia, EVP of Global Operations, said:

“Our HBM 12-high yields are doing better than our initial HBM 8-high ramp was a year ago at this time and better than our expectations.”

This signals clear improvement in Micron’s production capabilities, and provides an optimistic view of what their HBM4 yields might look like.

Conclusion

A strong earnings report, driven by higher-margin DRAM, especially HBM, which delivered a massive 50% QoQ growth.

I expect Micron to be a major compounder in the AI era, with a formidable moat; just look at the time and capital required to build even a single fab, let alone the multi-phase megafabs Micron has planned.

In the quarters ahead, gross margin trends will be a key metric to watch.

The stock is currently trading at ~13x NTM EPS, and with new fab capacity coming online starting in 2028, Micron is preparing for a second wave of growth, one that could last a very long time.

AI demands memory, and Micron is perfectly positioned to supply it.

For a deeper look at the investment opportunity in Micron, check out my full deep dive here.