IREN: 100x or Bust?

A Highly Controversial Bitcoin + AI Infrastructure Play: What’s the Real Potential of IREN?

I haven’t been the largest IREN advocate.

It’s not that I don’t like the company, I’ve just pointed out misconceptions I felt needed to be clear.

Some people don’t understand a series of key points that are essential to truly understand this company:

– What’s the core business?

– Are they an AI company?

– How are they funding their expansion?

– Why are they underperforming compared to Bitcoin or other AI names?

– Will they have an AI cloud? What even is an AI cloud?

For that reason, I wanted to make this article on the company, finally giving a neutral and comprehensive take.

Let’s start.

1 - The Beginnings

IREN Limited, formerly known as Iris Energy, was founded in 2018 by brothers Daniel and Will Roberts in Sydney, Australia. Their vision was clear from day one: build world‑class data center infrastructure powered entirely by renewable energy. Instead of chasing quick gains in crypto, they focused on long‑term asset ownership and sustainability, tapping into their prior experience in infrastructure development and finance.

In the early years, the company raised over $200 million in private capital. With this, they launched their first projects in British Columbia, Canada, leveraging abundant hydroelectric power to keep costs low and carbon emissions near zero. The Canal Flats facility came first, followed by larger deployments in Mackenzie and Prince George. Each site was chosen based on factors like energy surplus, cooling efficiency, and scalability.

By 2021, Iris Energy was ready to go public. In October 2021, the company restructured under Australian law to become Iris Energy Limited. A month later, in November 2021, it debuted on the NASDAQ under the ticker IREN, raising roughly $231 million at a $28/share IPO price. This marked a major inflection point, giving the company access to broader capital markets to fuel its next phase of growth.

Over the following years, IREN scaled fast. By early 2023, it had surpassed 5.6 EH/s of Bitcoin mining capacity and began breaking ground in the U.S., specifically in Childress County, Texas. The Texas site was particularly notable, with ambitions to reach over 1 GW of total capacity, making it one of the largest renewable-powered data center campuses in North America.

But 2024 marked a strategic shift.

On February 15, 2024, the company officially rebranded from Iris Energy to IREN, aligning its identity with the NASDAQ ticker and signaling a broader mission: not just Bitcoin mining, but powering high-performance compute (HPC)—including AI training and inference workloads. The name change became legally effective in Australia on November 28, 2024.

By 2025, IREN had evolved into a dual‑platform infrastructure company.

On one hand, it continues to be one of the most efficient and sustainable Bitcoin miners globally. On the other hand, it’s rapidly positioning itself as a player in AI compute, building high-density facilities ready to host GPU clusters. With 360 MW already online, 550 MW under construction, and a pipeline exceeding 3 GW in total land and power rights, IREN is clearly thinking big.

2 - The plan

IREN’s strategy is to keep mining Bitcoin at profitable rates, and with those proceeds, invest in its AI data center business.

Things are moving forward.

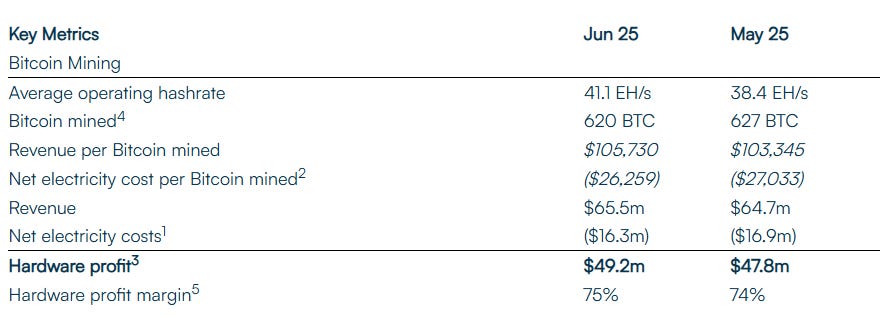

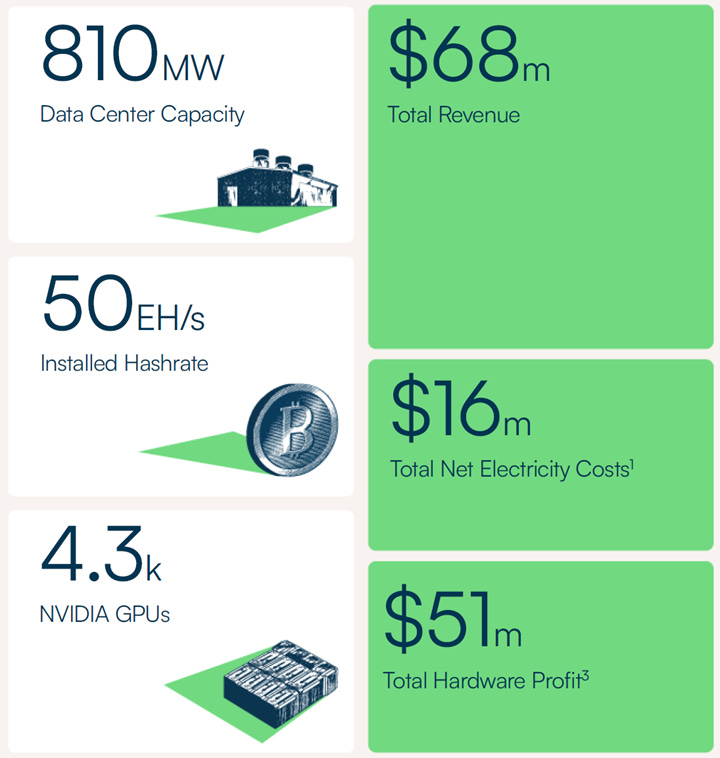

As per their last June update, they are now making $49M in Bitcoin mining proceeds monthly.

On top of that, IREN has also been buying NVIDIA GPUs, and with these, they’re now rolling out their own AI cloud. The proceeds from this have already reached $2M for the month of June.

In total, IREN is generating $51M in hardware profit(gross profit) per month:

With these $612M in gross proceeds, IREN now intends to reinvest in developing new AI data centers, expanding its AI cloud, and offering colocation services.

IREN also published a table showing their EBITDA estimates based on their current 50 EH/s hashrate:

With BTC approaching $125K, generating over $700M in annualized adjusted EBITDA seems like a reasonable target.

Although these numbers sound strong, one must not forget the investments required to set up this infrastructure. These costs aren’t included in the adjusted EBITDA calculation.

For example, in Q1 2025, IREN’s free cash flow was a negative $350M.

Let’s see where that money is going

3 - Infrastructure plan

What is IREN investing so much money in? Three verticals:

Bitcoin mining hardware

AI data centers

AI accelerators

In the last reported quarter, IREN's capex amounted to $450M.

As per the report, the large $298M figure is primarily composed of mining hardware prepayments to reach their 50 EH/s milestone.

Apart from the mining hardware, IREN is expanding its data center portfolio:

Laying out a tremendously ambitious plan to expand their data center capacity by 260%.

Right now, most of their capacity is used for Bitcoin mining.

That’s the case with their Mackenzie, Prince George, Canal Flats, and Childress data centers.

However, that is going to change soon.

They already have a multi‑thousand GPU deployment in Prince George, with ~47 MW of additional air‑cooled capacity there, capable of supporting over 20,000 B200s.

Then comes their 50 MW expansion in Childress, called Horizon 1.

And most importantly, with their massive Sweetwater project:

Both of these sites will be prepared not just for the current generation of AI accelerators, but also for what’s coming next. With a rack density of 200 kW, it vastly surpasses the 140 kW requirement of even the next GB300 NVIDIA system.

IREN’s experience managing large‑scale compute deployments will be crucial for this new AI venture.

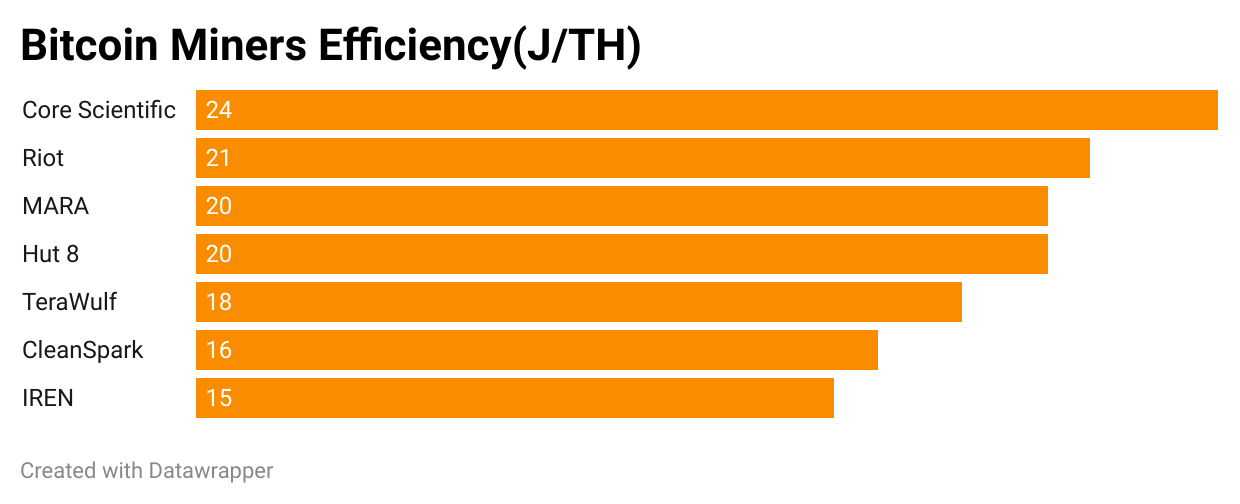

For example, look at the efficiency they’re able to achieve compared to peers (lower is better):

Tremendous efficiency, even next to a large‑scale developer now acquired by CoreWeave like Core Scientific. This type of expertise and know‑how is what makes investors so bullish on IREN. If they can adapt this to become a top‑notch AI data center developer, they could turn into a key high‑quality supplier of a core infrastructure component.

IREN has also invested in their own AI cloud, which they’re currently building in available space at their Prince George data center.

With a fleet of 4.3K NVIDIA GPUs, composed of 1,896 NVIDIA H100 and H200 GPUs, 1,300 B200, and 1,100 B300, IREN aims to run a mixed model:

Bitcoin mining as the cash‑generation base, colocation services (renting state‑of‑the‑art data center space to other AI cloud providers), and their own AI cloud.

In my opinion, what IREN is trying to do with their AI cloud covers more than meets the eye. If they are able to run these GPUs without issues and with a high energy efficiency (PUE), they will prove to the market that they can build not only Bitcoin‑mining data centers but also AI data centers. That would be a key accomplishment to build social proof, a necessary step to gain the market’s confidence.

It’d also be a key negotiation leverage. If they focus only on colocation, they could be subjected to lowballing by hyperscalers. But if they also deploy their own GPUs, they can say: either you use the capacity or I use it, it’s not the end of the world if you don’t want it.

They are already showing promising results: according to their 2024 Investor Day presentation, they achieved a PUE lower than 1.1 in their Prince George GPU deployment.

For comparison, the average PUE of data centers, according to Uptime Intelligence, is 1.56, while major cloud providers like Azure, Oracle, Alibaba, and IBM report averages between 1.12 and 1.46.

We’d need an update on this PUE for 2025, but if the initial figures are already this good, what kind of PUE could they achieve with a next‑gen, fully optimized data center?

If these claims are true and they can deliver at scale, we might be looking at a leading player in the space.

4 - The AI Cloud Dilemma

Iren offers AI cloud services with their NVIDIA GPUs. However, one shouldn’t mix this with what companies like Coreweave or Nebius offer.

What Iren provides is called baremetal, and that’s a very different model from a fully managed AI cloud platform.

With baremetal, you’re essentially renting raw infrastructure. Think of it as access to GPU servers with minimal layers on top. You get the hardware, but you handle your own software stack, orchestration, security, and scaling. It’s powerful and gives you full control, but it demands deep expertise from your side.

On the other hand, companies like Coreweave or Nebius are building full managed AI clouds. They offer orchestration layers, developer tools, container management, and often pre‑integrated AI frameworks. Instead of just a server, you get a full environment designed to run AI workloads at scale, with built‑in support, monitoring, and optimization.

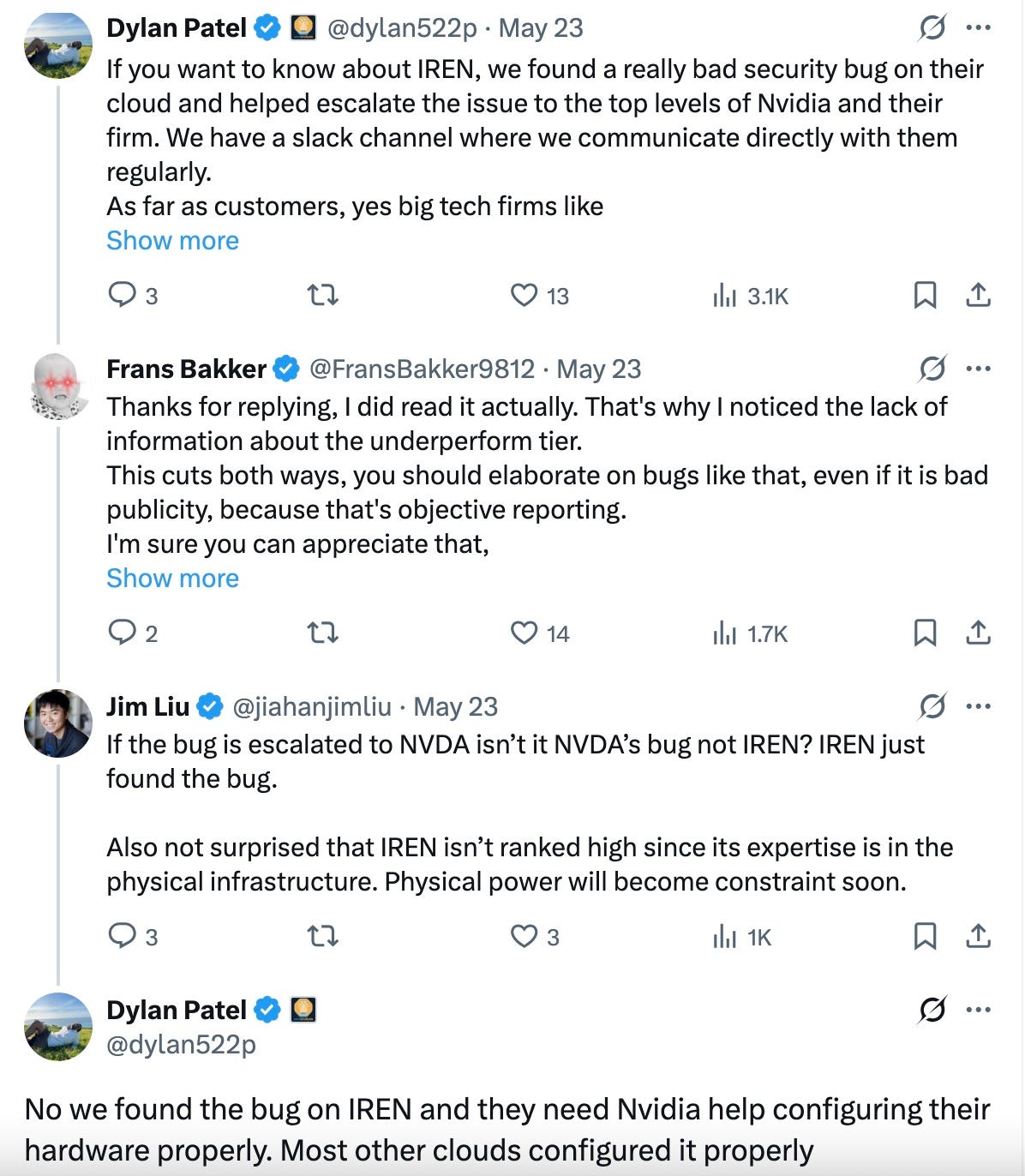

An example of the importance of software expertise can be seen in SemiAnalysis NeoCloud ranking:

Iren ranked in the lowest category.

They had a security bug on their AI cloud that had to be escalated directly to NVIDIA for configuration help. As Dylan Patel noted, most other cloud providers configured their GPUs properly from day one, while Iren needed NVIDIA’s assistance.

In short, Iren gives you the hardware, while Coreweave and Nebius deliver a full ecosystem. Both have value, but they serve very different customers and require different levels of expertise and commitment.

5 - CAPEX and Funding

The biggest issue to solve comes here. Building 1 GW+ data centers is exciting, but it’s far from cheap.

IREN forecasts a cost per MW of IT load of $6–7M.

Their plan is to build 2.1 GW over 2.5 years. At an average $6.5M per MW, that would amount to around $13.65B.

As per their last quarter, IREN had $184M in cash. They raised $550M in the form of convertible notes:

– $53.8M to fund the cost of the capped call transactions

– $92.5M to fund the cost of the prepaid forward transaction

– The rest, which amounts to $404M, for general corporate purposes and working capital

When you subtract the same amount of money they spent in Q1, they would now have around $238M left after an estimate of Q2 expenses.

That’s very far from the $13.65B in needed capex to fulfill their plans.

IREN isn’t the first company that needs huge capex investments to then reap the profits. Take the example of Tesla: they didn’t reach positive free cash flow until after 10 years of being public.

Now, there’s a fundamental difference between a company like Tesla and IREN regarding their access to capital.

Tesla went from nothing to a trillion‑dollar company, and in the process, they diluted 100% of their shares.

IREN, on the other hand, has diluted its share count by over 100% just in the last year and a half, and by 1,000% since 2021.

This, of course, isn’t necessarily the end of the world, but it helps clarify a few things.

It’s precisely the reason why they have underperformed against Bitcoin in the last year, even when over 95% of their revenue comes from Bitcoin.

The problem with IREN is that they can’t access capital as easily as others because they’re a small company and they haven’t secured a contract with any hyperscaler.

For example, they could enter into a contract where they receive upfront money to finance a project and then provide the colocation services.

That was the case with the deal CoreWeave had with Core Scientific before the acquisition: CoreWeave wired about $1.5 million upfront for each megawatt of AI power it leased. Core Scientific booked that cash as deferred revenue and used it to build the powered shell.

Once a hall went live, Core Scientific billed rent and applied 50% of every invoice to work down the prepaid balance until it was gone. After the acquisition, this pre‑payment system ended because the two companies became one.

However, right now, IREN doesn’t have such a convenient option. They have to rely on convertible notes, which are dilutive, as well as straight dilution.

Of course, they’re also getting cash from their Bitcoin operations, but even if they kept expanding their hashrate and collected only gross margin (what they call hardware profit), it would amount, at the current rate and conditions, to about $1.75B in 2.5 years. That’s still far from their ~$13.65B in investment requirements.

However, there is something that might save the day.

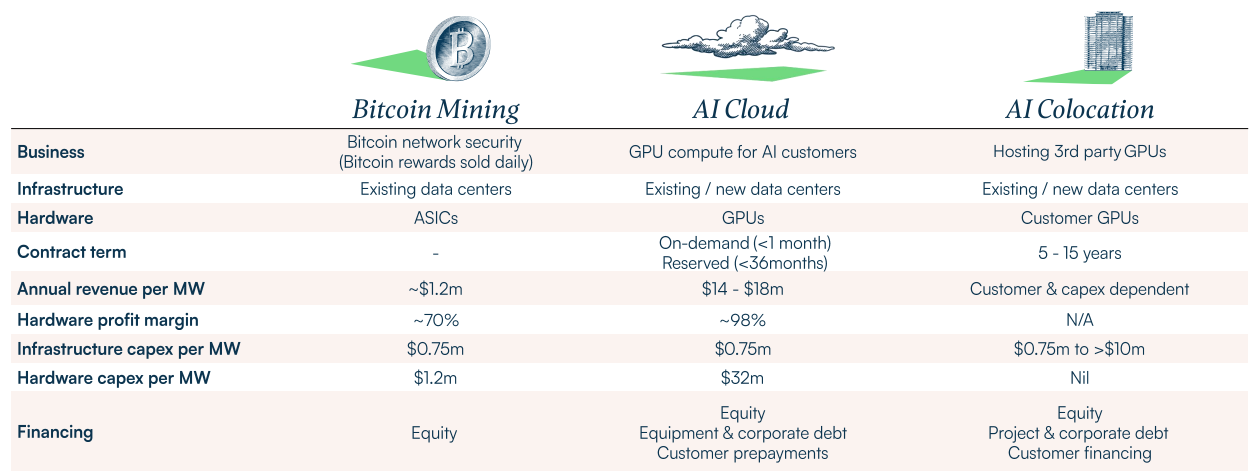

In their Investor Day presentation of 2024, they showcased some illustrative monetization options. In the table, they show an infrastructure capex per MW of $0.75M for AI Cloud, and $0.75M to over $10M for AI Colocation.

This seems hard to grasp. How could there be such a range in cost for AI colocation, to the point it could be 10 times higher than their cost per MW for their AI cloud?

In the notes, they explain:

Infrastructure capex per MW of Bitcoin Mining and AI Cloud reflects capex for current data‑center design ($750K per MW).

Infrastructure capex per MW of AI Colocation depends on a variety of factors, including customer preferences around redundancy and cooling solutions. The low end reflects capex for current data‑center design ($750K per MW) while the upper end (>$10M) reflects publicly observed benchmarks.

I could use the $750K figure as a bullish scenario, but I believe it’s highly unrealistic. Core Scientific posted a $1.5M per MW cost to retrofit Bitcoin miner data centers into AI data centers, and the industry average is around $7M. In fact, seeing that IREN themselves project their cost per MW of IT load at $6.5M for Horizon 1 as per their last presentation, that’s the safest bet.

Considering this, what are IREN’s options?

One is to issue more convertible notes, and another is to dilute shares. They’re probably going to do both, apart from other more compelling financing options we’ll see later.

In their last quarter, IREN issued $107M in shares:

That amounted to a ~5% dilution in a single quarter. Assuming they can issue $1B in convertible notes per year, plus their $1.75B in gross profit generated by their Bitcoin miners over the next 2.5 years, that would amount to a total of $4.25B, still $9.4B short of their capex requirements for the same period.

How is it possible to bridge this gap?

See, this is the problem. Some people try to say:

“Well, IREN is going to have 2.91 GW of capacity, and at a valuation of $11M per MW, which is in line with the valuation of Core Scientific or the newly Blackstone‑acquired AirTrunk, that would amount to a possible $33B enterprise value.”

This enterprise value includes both the market cap and the net debt. So after you get diluted, as an investor, what could be your return? Let’s say IREN has to take on $2.5B in debt and dilutes 100% of their shares. As an investor, you’d see your returns more than cut in half.

Still, a $33B enterprise value is quite steep. Even after removing the debt and assuming your return gets cut in half, it would still represent a ~300% return. Not bad for 2.5 years.

The thing is, can IREN, with its current cash available and a $3.8B market cap, accomplish this project with just 100% dilution, $2.5B in convertible notes, and the cash generated by their Bitcoin operations? Even if you put all that together, it would amount to only $8.05B, which falls short of what they need to accomplish this project.

Of course, this calculation is too simplistic.

It doesn’t take into account factors such as the revenue that IREN will start generating with Horizon 1 and Sweetwater 1 in 2026, nor the gradual increase in market cap as the company grows that will offset part of the dilution, as well as their AI cloud operations.

Right now, the revenue from those operations is almost insignificant at $28 M ARR, and expanding them would require even more capex, which would make the calculation even harder. However, with the new Blackwell installations, it could increase by an estimated ~200%.

For this reason, let’s use a more complex valuation method that truly illustrates what the future of this company, in terms of capital structure and balance sheet, could look like.

6 - Valuation

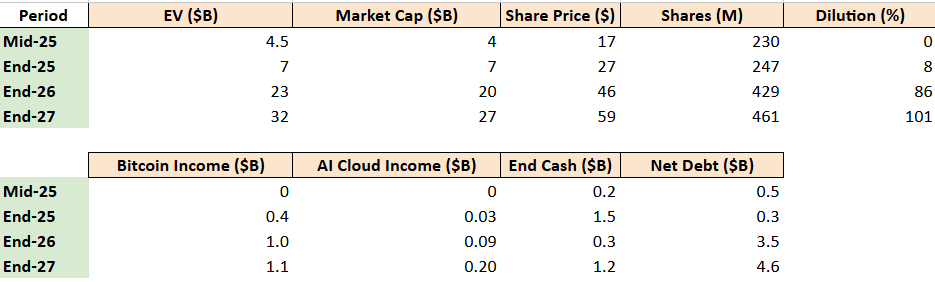

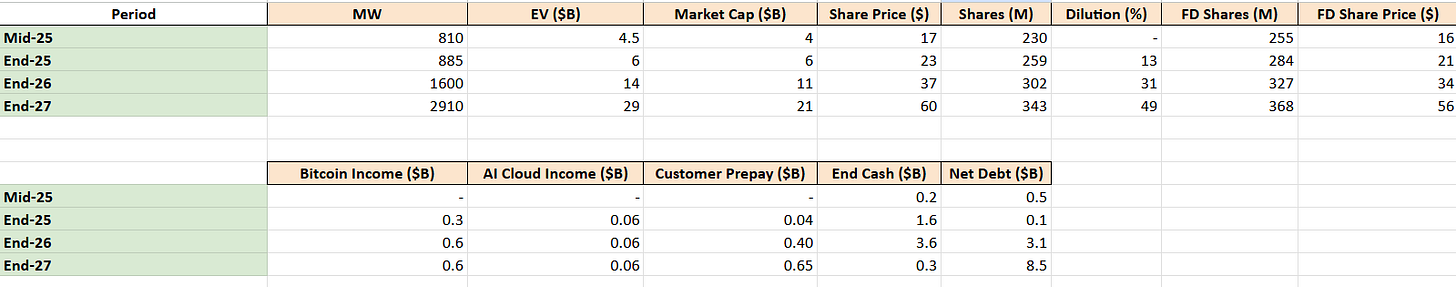

I’ll now model different scenarios so we can picture the possible upside with IREN:

Scenario 1

A more simplistic and less bullish approach, relying heavily on equity raises and assuming no alternative financing structures (no vendor financing, no sale‑leasebacks, no project loans). This leads to higher dilution even though the final enterprise value is the same.

Assumptions:

Bitcoin price deck: $120 k (’25) → $160 k (’26) → $180 k (’27)

Capex: $0.49 B (’25) → $9.26 B (’26) → $3.90 B (’27) ⇒ $13.65 B total (no other growth capex)

AI‑cloud revenue: ramps to $200 M in 2026 and $300 M in 2027

Minimum cash floor: $150 M (’25), $250 M (’26), $300 M (’27)

Debt ladder (convertibles only): $0.3 B (’25) → $1.0 B (’26) → $1.5 B (’27); legacy debt remains $0.76 B

Equity plug: $1.0 B (’25) → $6.0 B (’26) → $6.1 B (’27)

No alternative financing: no vendor leases, no sale‑leasebacks, no customer pre‑pays, no project loans

Starting BS: $238 M cash • $760 M debt • 230 M shares

Valuation/MMW: steps from $5.6 M → $8 M → $10 M → $11 M as AI mix grows

Results:

Final EV (end‑2027): ≈ $34 B

Share‑price change (2025→2027): ≈ 2.9 × (≈ $17.39 → $51)

Cumulative dilution: ≈ 176 % (230 M → ~667 M shares)

Total return by 2027: ≈ 191 % (≈ 53 % CAGR)

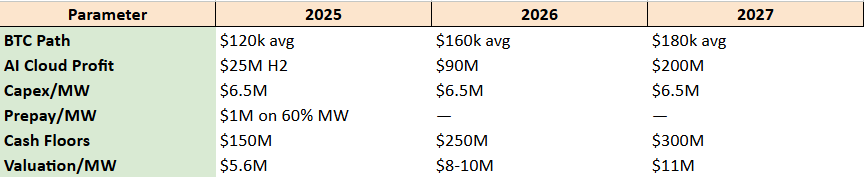

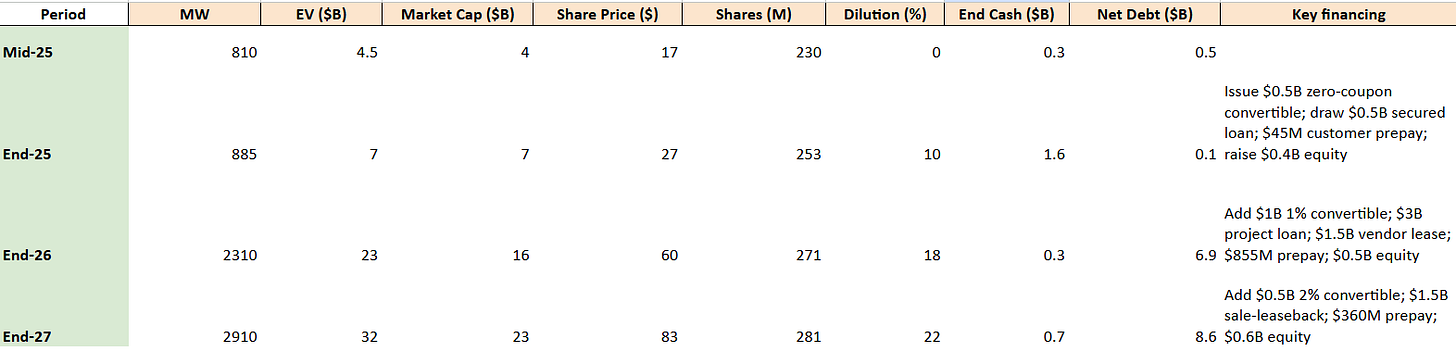

Scenario 2

A more bullish and more realistic approach, using a layered financing strategy (converts, project debt, vendor deals, pre‑pays) before resorting to equity. This leads to lower dilution and a stronger balance sheet while still covering the full capex plan.

Assumptions:

Bitcoin price deck: $120 k (2025) → $160 k (2026) → $180 k (2027)

Build‑out: ~3 GW online; MW valuation assumed to step $5.6 M → $11 M by 2027

Financing order: low‑coupon converts → secured/project debt → vendor & sale‑leasebacks → customer pre‑pays → equity for any residual gap

Equity cadence: $0.4 B (’25 ATM) → $0.5 B (’26) → $0.6 B (’27) total primary issuance ≈ $1.5 B

Customer pre‑pays: $45 M (H2‑25) + $855 M (2026) + $360 M (2027) advance rent on AI‑colo space

Leverage: net‑debt/EV peaks ≈ 27 % (2026) then slips to ≈ 24 % (2027)

Operating uplift: AI‑cloud profit ramps to $25 M (H2‑25), $90 M (’26), $200 M (’27)

Results

Final EV (end‑2027): ≈ $32 B

Share‑price path: ≈ $17.4 (2025 start) → $31 (end‑25) → $63 (end‑26) → $86.5 (end‑27)≈ 4x overall

Cumulative dilution: ≈ +24 % (shares 230 M → ≈ 285 M after new equity)

Exit net‑cash vs debt: end‑’27 cash ≈ $0.5 B; total financial debt ≈ $8.0 B; net‑debt/EV ≈ 24 %

7 - Risks

BTC falls off a cliff

The whole plan starts with Bitcoin hovering in six‑figure territory. If it does what it’s done before, slice itself in half after a hype cycle, hardware profit would decrease by a lot. That doesn’t just dent earnings; it forces you to fund day‑to‑day capex with fresh equity right when the share price is limping.AI‑cloud suddenly gets cheap

Today, you can still rent an H100 at $6–7 per GPU‑hour, but hyperscalers are racing to fill their own halls. Once supply outruns demand, rates slide, maybe below $2. If that happens, your $90 M annual run‑rate turns into $40 M in a hurry, and colo customers start asking for rent concessions.Capex and schedule creep

Ramping 1.4 GW of high‑density capacity in a year is marathon‑pace construction. One muddy spring, a delayed transformer shipment, or a county‑level permit could push energization back six months.Financing turns unfriendly

The model leans on 6‑8 % project debt and zero‑coupon converts. If SOFR jumps 150 bp or the bond desk demands an actual coupon, annual interest eats another $100 M. Meanwhile, every follow‑on equity deal will want a 15‑20 % discount to screen price. More coupon, bigger share count, both squeeze the per‑share upside you’re pitching.Grid & policy curveballs

Texas ERCOT is great, until it isn’t. When the grid’s stressed, curtailment or spot‑power spikes can whack operating margins for days. Layer on the possibility that regulators decide GPU farms must report carbon and water use in real‑time. That’s new capex, new operating hoops, and possibly slower permitting—none of which is in the base case.

Considering the risks, the ambitious nature of the plan, the current uncertainty around the future price of Bitcoin, and the volatility in GPU rental pricing, we should also account for the fact that IREN doesn’t have any solid client backing them.

Scenario 3

Let’s build a third scenario where we assume more convenient financing options but place them in an overall less favorable environment. In the model below, I lower the assumed Bitcoin price, which can be interpreted either as a potential Bitcoin downturn or as a scenario with thinner margins driven by higher electricity costs.

Assumptions:

BTC deck: $84 k (’25–26) → $91 k (’27)

Build‑out: slip to 1.6 GW by end‑’26, catch‑up to 2.91 GW by end‑’27

AI‑cloud profit: capped at $60 M/year from H2‑25 onward

Customer pre‑pays: 10 % off base case (H2‑25: $40 M; ’26: $770 M; ’27: $650 M)

Financing: same layered stack, but equity trimmed to $0.5 B/ $1.0 B/ $0.4 B

Capex rescheduled: $0.49 B / $5.0 B (’26) / $8.16 B (’27)

Cash floors & legacy debt unchanged

Results:

Final EV (12/27): ≈ $29 B

Share‑price path: $17.4 → $26.8 → $38.0 → $61.9 (≈ 3.6×)

Dilution: +42 % (230 M → 327 M shares)

Exit liquidity: Cash ≈ $0.44 B; Gross debt ≈ $7.0 B; Net‑debt/EV ≈ 30 %

8 - Conclusion

As we can see, there is a path for IREN to become a successful investment. As they grow, they’ll gain easier access to capital. Convertible note offerings will be able to increase without growing as a percentage of market cap. Prepayments, a high Bitcoin price, and a bullish market cycle that keeps the market cap elevated (especially the latter) will be key for the success of this company.

Am I buying?

Right now, I’m not. As bullish as my models look, I have doubts about management, I have doubts that the price per MW will stay the same, and I also don’t know if we’re going to remain in a bullish cycle for 2.5 years, something that is crucial in this thesis.

On top of that, there are other risks I’ve outlined: delays, tariffs, commoditization, poor financing management, and lack of interest in colocation could all significantly reduce the expected returns.

Anyway, I hope this was a useful article. If you want to know what I’m actually buying, check my latest portfolio update.

Rating: Slight Buy

Short Term: Slight Buy

Moat: 6/10 – Hard assets combined with a technological edge compared to peers

“Today, you can still rent an H100 at $6–7 per GPU‑hour”. Actually, in Nebius (I’m both retail investor and customer) you can rent H100 instances per 3$/hour…