Block: A Misunderstood Gem?

Once overhyped, now overlooked. Is the story really over?

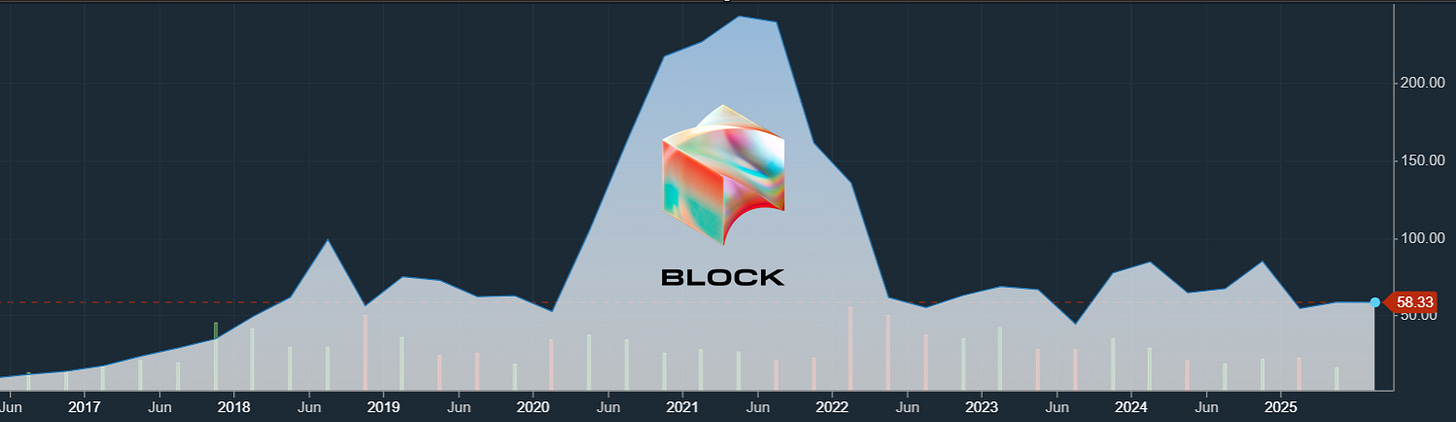

Block is one of the most controversial companies in the fintech space. It’s no surprise, given who its CEO and founder is. Jack Dorsey has proven to be a great founder, a creative mind from which successful ideas can arise. However, his role as a CEO has been questionable. Some of his decisions, combined with the burst of the 2021 bubble, have taken the stock down 80% from its all-time highs.

But the company has never been better. Revenue continues to grow, Block has added Afterpay, Tidal, Bitkey, and Proto to its lineup, and margins have never been stronger.

Now that retail seems largely bearish on the company, Wall Street is turning bullish. Most analysts have issued buy ratings, and the trend has strengthened in recent months.

So the question is: should retail start looking at Block in a different light?

The rise and fall

Block, previously known as Square, was one of the hottest stocks of 2021, reaching a price of $273 compared to today’s $54. Square was massively popular among retail investors. It became a top pick across social media, and it wasn’t just retail. Analysts had an average price target of $260 in July 2021.

To name a few:

• Deutsche Bank had a target of $330

• Mizuho Financial Group set theirs at $380

• Dan Dolev said: Buying Square stock is like buying JP Morgan in 1871

Square was called the future of fintech, praised for its growth, its modern approach, and Jack Dorsey’s long-term vision. But Square was undoubtedly a bubble, like many stocks back then. The problem is, while other fintech names like Robinhood or Affirm have recovered a good portion of their losses, Block remains stuck in a downward spiral.

The Tidal misstep

Block reached its peak market cap in August 2021, $127 billion, shortly after the Tidal acquisition. They had to issue new shares to buy an 88% stake for $297 million in a relatively unknown music streaming service.

It raised eyebrows. Why is a fintech company buying a niche music service?

It didn’t make much sense until you realized one of Tidal’s primary owners was Jay-Z, a close friend of Jack Dorsey. After the acquisition, Jay-Z joined Block’s board, a position he still holds today.

The move sparked internal tension. According to three employees, Block’s management issued “stern warnings” to avoid mentioning Shawn Corey Carter (Jay-Z) in any internal communications, whether via email or Slack.

Criticism poured in. Many saw the deal not as diversification, but as diworsification.

Some believed Tidal might expand the Square ecosystem into music, or integrate with Cash App in creative ways. But none of that played out. Tidal lost support on Samsung TVs, Roku, and Plex. In 2023 and 2024, the platform laid off a large portion of its staff. Eventually, Block admitted it was scaling back investment in the company.

Afterpay and dilution

In December 2021, Block acquired Afterpay in an all-stock deal, issuing over 113 million shares and valuing the buyout at $13.9 billion. That meant diluting 20% of the company’s float to get the deal done.

Many saw this as another example of Dorsey overpaying, and it’s easy to see why. When the deal closed, Afterpay’s implied valuation was $29 billion, nearly the same as Block’s current market cap of $33 billion.

Like Teladoc, Block ignored basic valuation and cycle dynamics, focusing too heavily on qualitative upside. The result? Overpriced acquisitions that hurt the stock for years.

The fundamentals broke down

And that wasn’t the only issue.

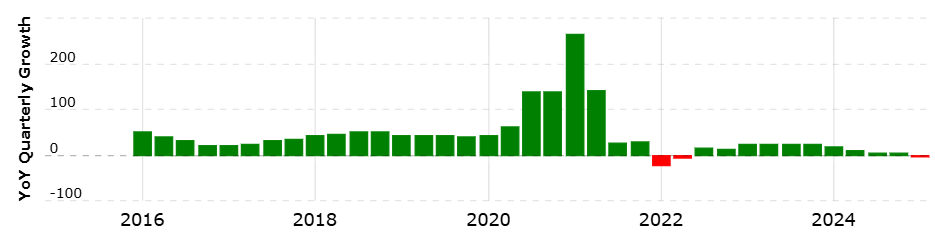

Block’s sales grew 85% in 2021, an insane figure that pulled in a wave of hype. But just one year later, that growth turned negative. Profitability collapsed. Revenues slowed while operating expenses soared 50%, largely due to an overextended workforce. The company turned unprofitable.

So you had the 2021 bubble, the questionable Tidal deal, Jay-Z on the board, the massive Afterpay dilution, and the sudden slowdown of the business. That was a recipe for disaster. Block’s stock fell over 60% in 2022.

Cleaning up the mess

But something started changing in 2023 and 2024.

There have been layoffs. Their new “TBD” project was disbanded. Investment in Tidal has been cut. And the company is finally focusing on what it should:

• Cash App

• Square

• Integrating BNPL within their products

• Expanding their Bitcoin ecosystem through Bitkey and Proto

You could say this company is like a junkie getting clean. After years of excess, it’s refocusing. Cutting distractions. Doubling down on its strengths.

And that has many investors wondering the same thing:

Is this a buying opportunity?

Let’s explore it.

Cash App

Cash App is a mobile platform that lets users send, receive, spend, invest, and borrow money, all through a clean and intuitive interface. It competes directly with Venmo (PayPal), Zelle, Apple Pay, and, to some extent, Robinhood, Chime, and Coinbase.

It’s currently the most-used financial app in the United States.

It’s extremely popular among younger generations and is evolving into a true all-in-one super app. By layering multiple financial services on top of each other, it has transformed from a simple payment app into a bank account, investment platform, and crypto wallet, all in one place.

To begin with, Cash App has already become a bank.

Cash App is the 4th largest debit card issuer in the U.S. and the fastest-growing.

Historically, like many fintechs, Cash App faced a major limitation with lending: it had to rely on an external banking partner. That’s no longer the case, and this is a game-changer.

Block now has its own bank: Square Financial Services.

It already provides loans for businesses under the Square platform. However, until recently, Cash App hadn’t been approved for consumer lending. That has now changed. With FDIC approval in place, Square Financial Services can now originate loans directly to Cash App users.

This is a huge deal; no other fintech can claim this.

Block is the only one with a wholly owned, FDIC-approved bank. This unlocks:

• Tighter vertical integration across the financial stack

• Faster settlement times → better cash flow for users and merchants

• Greater control over risk, compliance, and lending margins

Which translates into:

• Margin expansion

• Accelerated loan growth

• Deeper monetization of Cash App’s 57M+ users

The timing couldn’t be better. Cash App Borrow originations are set to hit $9B in 2024, a 150% YoY increase. With Square Financial Services now backing these loans internally, the economics improve dramatically. As lending margins expand alongside volume, earnings will soar.

It’s not just Cash App. Square Capital, the lending arm of Square, is already originating $5.7B in loans, growing 19% YoY.

Having an internal, FDIC-approved bank gives Block a long-term competitive edge:

better take rates, interest income, and operating margins.

In terms of revenue, although growth in new active users has stagnated at 0%, that’s understandable given the platform’s scale. Cash App is only available in the U.S., and it already has 57 million Monthly Transacting Actives, roughly one-fifth of the U.S. adult population.

Cash App grew gross profit by 10% last quarter, reaching an annualized figure of $5.5B. Just counting Cash App, Block would be trading at 6.4x gross profits.

Cash App + Afterpay

Cash App is now integrating Afterpay directly into its platform.

Afterpay U.S. is being rebranded as “Cash App Afterpay,” allowing customers to pay using their Cash App Card or directly through the app with Buy Now, Pay Later (BNPL) functionality.

This is massive for Afterpay, as it gains access to Cash App’s 57 million active users. It’s also a win for Cash App, which dominates among Gen Z, a demographic far more comfortable using BNPL than traditional credit cards.

And the shift is real:

A 2025 J.D. Power study found that 42% of Gen Y and Z consumers used BNPL, compared to just 21% of older generations. During the 2024 holiday season, Gen Z users chose BNPL over credit cards, the first time that’s ever happened in the study’s history.

These users are actively seeking better repayment terms, and BNPL is emerging as the preferred option.

So now you have:

• The largest financial app for Gen Z

• Powered by Afterpay

• Offering loans backed by Block’s internal FDIC-approved bank

Block’s long-term strategy is materializing, and its ecosystem advantages are more evident than ever.

Afterpay is a big deal.

It’s one of the largest BNPL providers globally. Originally from Australia, it dominates its home market and is now the second-largest BNPL platform worldwide, behind Klarna and roughly tied with PayPal.

While Afterpay’s take rate is lower than Affirm’s, its gross profit is surprisingly close:

• Afterpay: $970M

• Affirm: $1.25B

Affirm is growing faster, but Afterpay is still putting up solid numbers, with 22% YoY GMV growth.

Here’s what stands out:

Afterpay is a relatively small part of Block’s business, especially compared to Cash App ($5.24B gross profit) and Square ($3.6B). Yet it’s competitive with Affirm, and Affirm trades at only half the market cap of Block.

This implies one of two things:

Either Affirm is overvalued, or Block is deeply undervalued.

Maybe both.

Square

Just as Cash App is an ecosystem for consumers, Square is an ecosystem for businesses, focused on helping merchants run their operations, both online and offline.

Square is a merchant services and point-of-sale (POS) platform that provides tools for small and medium-sized businesses (SMBs) to accept payments, manage operations, and access financing. It started as a simple hardware device that plugged into smartphones to let anyone accept credit card payments, but has since evolved into a full commerce and financial ecosystem.

It competes with PayPal, Shopify POS, Toast, Clover, and legacy systems like NCR.

Square now offers a wide range of services that cover nearly every aspect of running a business:

• Point-of-sale and payment hardware

• Software solutions

• Online & e-commerce tools

• Financial services

• Invoicing, loyalty & CRM

• Developer APIs

Square revenue is growing at 7.2%, with gross profit up 9%, reaching $898M.

Although the low growth is concerning, context matters. The U.S. economy showed tariff-related weakness, with consumer spending growing only 1.6%. That partly explains why a company so sensitive to consumer behavior may be experiencing softer growth.

In the long term, as they continue expanding their Square products and the loan side of the business, they’ll keep growing steadily, as more businesses transition to a modern, comprehensive ecosystem with the highest consumer satisfaction in the market.

Bitkey

Bitkey is a self-custody Bitcoin wallet developed by Block.

It’s one of Jack Dorsey’s most ambitious projects, aimed at empowering people globally to secure and control their Bitcoin without relying on centralized exchanges or custodians.

Bitkey isn’t just an app, it’s a full system that combines:

• A mobile app

• A hardware device

• Cloud backup infrastructure

The goal? To make self-custody simpler and safer for everyday users.

Unlike most wallets, Bitkey uses a 3-key system (multi-sig) to offer both security and recoverability. It’s designed to:

• Reduce the technical barrier to self-custody

• Empower users in emerging markets to own Bitcoin safely

• Provide a middle ground between ease of use and sovereignty

Bitkey is part of Block’s broader Bitcoin vision, alongside other initiatives like its mining projects and Lightning infrastructure via Spiral.

While Bitkey adoption is still niche, the context is changing. With Bitcoin’s rising price, expanding use cases, and growing demand for cold storage solutions, Bitkey could add another meaningful layer to the overall Block ecosystem.

Proto

Proto is one of Block’s newer ventures, focused on building Bitcoin mining ASICs and full rack systems, with the goal of developing the most competitive Bitcoin miner on the market. It’s a strategic move that fits squarely into Block’s broader Bitcoin ecosystem.

This could become a major growth driver for Block.

The Bitcoin miner market is expected to surpass $25 billion by 2030. Today, most mining hardware is imported from China. Block is aiming to offer a U.S.-based alternative, with better performance and reliability.

To do this, the Proto team is innovating by:

• Building 3nm mining chips, manufactured by TSMC

• Collaborating with Core Scientific on mining rig design

To reinforce the seriousness of this effort, Core Scientific has already prepaid $21.3 million for these ASICs, with delivery expected by Q3 2025.

The Bitcoin bet

Block is one of the most bullish companies on Bitcoin, and that’s reflected not just in its business ventures but also on its balance sheet. Block currently holds the 10th largest corporate Bitcoin treasury in the world, with 8,594 bitcoins, valued at approximately $914 million.

To continue this accumulation, in the second quarter of last year, Block announced it would invest 10% of its gross profit from Bitcoin-related products each month into purchasing the asset. This is, of course, a controversial move, one that, in my opinion, has further worsened Wall Street’s perception of the company.

Now, investing in Block isn’t just about backing a tech-forward fintech company, it also means placing a bet on an asset class many investors still view with skepticism.

Tidal and AI bets

Tidal, for now, contributes zero weight to Block’s valuation. It remains a wildcard. But if Block manages to integrate Tidal more deeply into its ecosystem and leverage AI to enhance the platform, it could become a surprise catalyst.

As Jack Dorsey hinted, Tidal could evolve into a “Square for musicians”, a complete platform to run a music business: managing royalties, payments, fees, expenses, and offering tools that save artists time and money.

In an effort to differentiate Tidal from other streaming platforms, Block could lean on its strong product team and AI investments. The company is actively investing in AI to enhance usability and stay ahead, especially as Gen Z expects seamless, high-performance tech experiences.

To support this, Block has invested heavily in infrastructure and is now the first company in North America to deploy NVIDIA’s new GB200 systems.

Block is already integrating AI into the Square platform. They recently launched Square AI, designed to give sellers smarter tools to automate operations and save time, including:

• Menu generators for restaurants

• AI image editors for ecommerce

• Email copywriting tools

• Website builders

• AI-assisted communications

These tools are expected to keep expanding.

If Block is innovating with Square, why not with Tidal?

Imagine: AI music generators, playlist builders, even AI-powered music editors. These could turn a failed product into a reimagined, potentially viral platform.

Of course, that may sound like wishful thinking, Block has historically moved slowly when it comes to adding features. However, the company is clearly undergoing a transformation.

On May 14, Block executed the largest product release in its history, launching over 100 new products and features.

This came right after a disappointing earnings report, where shares dropped more than 10%. While the release doesn’t fully rewrite Block’s valuation, it signals renewed energy and vision.

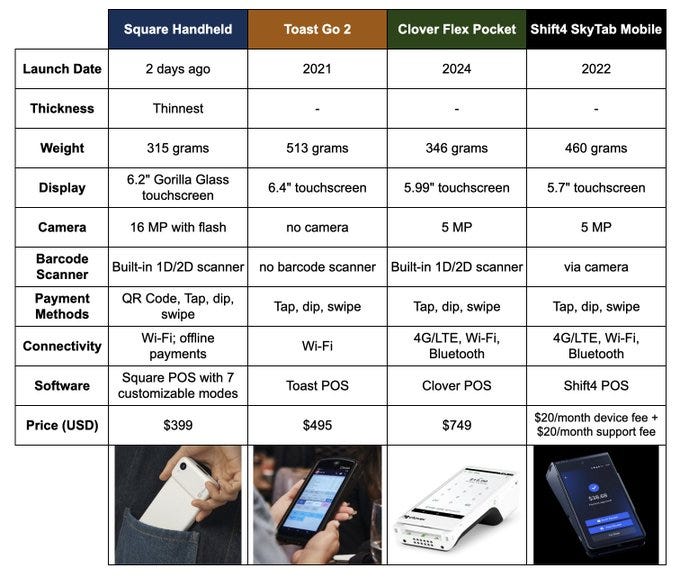

Among the new products, one stood out: Square Handheld, a portable POS device that enables sellers to manage everything from payments to back-of-house operations like Serve Tables or Manage Inventory.

Square Handheld offers the best features compared to similar devices from competitors:

This renewed wave of innovation and product development is exactly what Block needs in a highly competitive environment, where staying on the cutting edge is crucial. And to this day, there isn’t a higher-quality option available for merchants. In the long run, it’s Block’s focus on perfection and quality that will give them the edge.

Financials

Block went from a hypergrowth phase to a transition period, where it’s learning how to truly operate as a large company.

They can no longer function like a scrappy startup. They need to integrate products into a scalable ecosystem. And in my view, the numbers reflect exactly that, a company moving from high growth to slower growth with improving margins, and now preparing to enter a new wave of growth and renewed hype.

Let’s look at key year-over-year performance indicators from the last quarter:

• Revenue (excluding Bitcoin): +9%

• Gross profit: +7.6%

• Adjusted EBITDA: +15%

• Adjusted Operating Income: +28%

In summary, steady overall growth and rapid margin improvement.

The full-year guidance isn’t the most exciting, but it’s headed in the right direction.

Full-year 2025 guidance:

• Gross profit growth: 12% YoY

• Rule of 40: 31%

In summary, solid, though not thrilling, numbers. More will be needed to regain investor confidence. But if you truly see this as a transition period and focus on the massive potential and powerful ecosystems this company is building, a $36B valuation doesn’t seem high at all.

For that price, you’re buying:

• The most popular financial app in the U.S.

• A BNPL giant across Australia, the UK, Canada, New Zealand, and the U.S.

• An all-in-one ecosystem for businesses covering every financial and e-commerce need

• A wholly owned, FDIC-approved bank

• Plus Proto, Tidal, Bitkey, and an AI development team that could give Block a real edge over other fintechs

Looking forward

The most exciting part about this company is its vision of creating a fully integrated financial and commercial online ecosystem. The idea is to gradually connect their diverse, high-quality products in the most convenient and comprehensive way, so that businesses and consumers have no better alternative. And they’re actually starting to build it.

Cash App and Square already hold dominant positions in their respective markets. Both score high on customer satisfaction and continue to innovate by delivering exactly what users want. That innovative spark had dimmed for a while, but Block is reigniting rapid development across Square, and that gives shareholders the hope they need to keep believing in management’s long-term vision.

The ultimate goal is to become an ecosystem of ecosystems, merging the commerce and financial hub for businesses (Square) with the consumer-facing hub (Cash App). All of it vertically integrated with Afterpay for lending, backed by Square Financial Services.

Beyond that, Block aims to integrate Bitcoin as a core part of this ecosystem. They plan to enable BTC payments, potentially using the Lightning Network for fast, low-cost international transactions. They even want to close the loop by producing their own Bitcoin mining chips and rigs, allowing users to mine BTC and store it securely in their own Bitkey wallet.

And tying everything together is their bet on in-house AI development, powered by NVIDIA’s new GB200 systems. These tools are being used to develop AI that can enhance every layer of their product stack.

It’s understandable that the market is uncertain. Sometimes, doing too much feels like doing nothing at all. A company can only stretch itself so far. But the opportunity here is massive, and if Block succeeds in bringing this entire vision to life, buying in today could be like investing in a misunderstood, early-stage giant that the market has yet to fully grasp.

Block looks like a value trap. It’s caught in a squeeze from both sides—Affirm is outpacing it in BNPL (Affirm’s GMV jumped 34.7% YoY to $10.1 billion in Q2 FY 2025), while its crypto push via Cash App runs headlong into Coinbase’s scale and breadth (Coinbase serves over 108 million customers). On top of that, Block’s sprawling ambitions—from Square merchant services to Tidal and Spiral—raise the bar for near-perfect execution, leaving little room for any one segment to stumble.

Good analysis you made very compelling points. I did a similar one on Shift4 if you want to check it out.